The Hydrogen Revolution Britain Isn't Building

Batteries work brilliantly for cars. For 44-tonne lorries crossing Britain, aircraft flying to Edinburgh, and ships reaching Rotterdam, batteries fail catastrophically. Hydrogen succeeds where electricity stumbles—if the state will stop suffocating anyone wanting to build it with over-regulation.

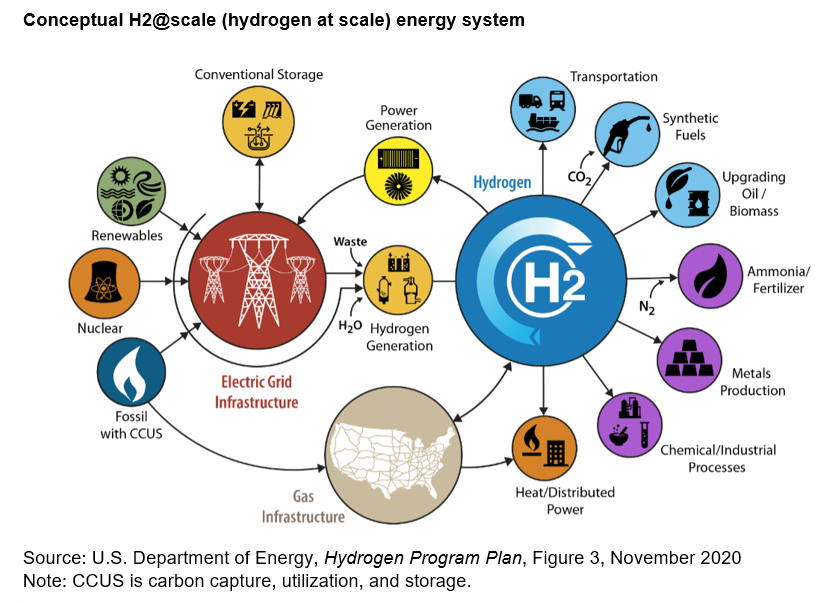

The search for a better portable energy source has led scientists, engineers, and policymakers to revisit hydrogen, the simplest and most abundant element in the universe. Whilst battery electric vehicles capture headlines and government subsidies, hydrogen offers something fundamentally different: the energy density needed to power long-haul lorries, ships crossing oceans, and aircraft flying between continents. The challenge lies not in the element itself but in the infrastructure required to produce, transport, and dispense it safely and economically across the United Kingdom.

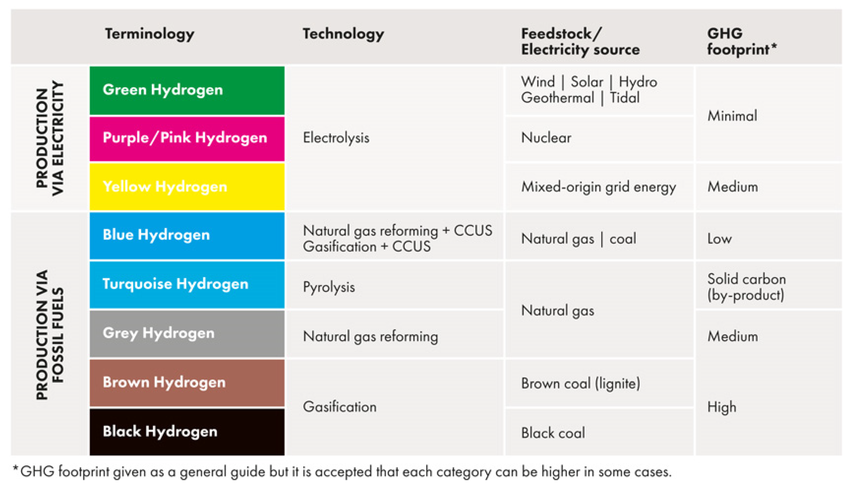

Understanding The Colour Spectrum

The hydrogen industry has developed an informal colour-coding system to distinguish between production methods, each carrying different environmental and economic implications.

Grey hydrogen dominates current production, comprising roughly 90% of the global supply. Produced through steam methane reforming without carbon capture, grey hydrogen releases substantial CO2 into the atmosphere—exactly the problem renewable energy seeks to solve.

Blue hydrogen represents an incremental improvement, using the same steam reforming process but capturing between 80% and 95% of the resulting carbon dioxide for underground storage. Whilst marketed as "low carbon", critics argue this description misleads, given the significant emissions escaping capture. The technology exists and functions, but calling it carbon-neutral stretches credibility.

Green hydrogen emerges from electrolysis powered by renewable electricity. Solar panels, wind turbines, or hydroelectric dams generate the power needed to split water molecules into hydrogen and oxygen, producing no carbon emissions during manufacture. The process remains expensive, though costs continue falling as renewable electricity becomes cheaper and more abundant. Green hydrogen's share of production hovers around 4% globally, but the UK government has set ambitious targets to expand this dramatically by 2030.

Then come the experimental colours. Turquoise hydrogen, produced through methane pyrolysis, splits natural gas into hydrogen and solid carbon rather than CO2 gas. The carbon can theoretically be captured and used in manufacturing tyres or other products, though the technology remains in early development stages.

Pink, purple, and red hydrogen all involve nuclear power—either the electricity from nuclear plants driving electrolysis or the extreme heat from reactors enabling more efficient hydrogen production. Yellow hydrogen specifically denotes solar-powered electrolysis, though the distinction from green hydrogen seems arbitrary given solar qualifies as renewable energy.

The most intriguing entry in the colour chart is white or gold hydrogen—naturally occurring geological hydrogen found in underground deposits.

French researchers discovered a reservoir in the Lorraine coal basin potentially containing 250 million tonnes of hydrogen, enough to rival the UK's largest oil field. Geologists now believe these deposits exist worldwide, formed through chemical reactions between iron-rich rocks and water or through radioactive decay.

Several British sites show promise, including areas in Scotland stretching from Greenock to Aberdeen, the Lizard peninsula in Cornwall, Shetland, and locations near Omagh in Northern Ireland. The UK has conducted no nationwide assessment of natural hydrogen potential, hampered by absent regulatory frameworks and licensing procedures. What a surprise. Exploration companies like Getech are using artificial intelligence to identify likely deposits, but actual drilling remains years away.

The Production Puzzle

Producing hydrogen at scale presents formidable obstacles regardless of colour. Steam methane reforming, the dominant grey hydrogen method, requires temperatures exceeding 700°C and operates continuously—stopping and restarting the process wastes energy and damages equipment. The infrastructure exists and has proven reliable for decades, but climate considerations make expansion of fossil fuel-based production increasingly untenable politically, if not economically.

Electrolysis avoids combustion entirely by using electricity to split water molecules. Two electrons pass through an external circuit, creating an electric current powering whatever needs electricity. The hydrogen atoms split at the cathode release protons and electrons, with protons passing through a polymer electrolyte membrane whilst electrons travel through wires. At the anode, electrons recombine with protons and bond with oxygen, producing pure water as the only byproduct.

The equipment costs remain steep. A commercial electrolyser system capable of producing meaningful quantities of hydrogen requires significant capital investment. The polymer electrolyte membrane (PEM) electrolysis uses expensive platinum catalysts and operates in corrosive acidic environments.

Alkaline electrolysis employs cheaper catalysts but suffers from slow start-up times and lower efficiency. Solid oxide electrolysis cells achieve the highest efficiencies but operate at extreme temperatures around 800°C, creating durability problems.

Producing one kilogramme of hydrogen through electrolysis requires roughly 50 kilowatt-hours of electricity—more in practice due to system inefficiencies. At current UK electricity prices, this makes green hydrogen expensive compared to fossil fuel alternatives. The government's hydrogen strategy assumes renewable electricity costs will plummet sufficiently by 2030 to make green hydrogen commercially viable, but this remains speculative rather than certain.

Hydrogen's tiny molecular size means it slips through seals and gaskets easily. Its extremely low density—about one-fourteenth the density of air—necessitates either compression to 700 bar pressure or cooling to minus 253°C for liquefaction. Both processes consume energy and require specialized equipment. The gas also causes embrittlement in certain metals, potentially leading to catastrophic structural failures if pipeline materials are chosen incorrectly.

How Hydrogen Fuel Cell Vehicles Work

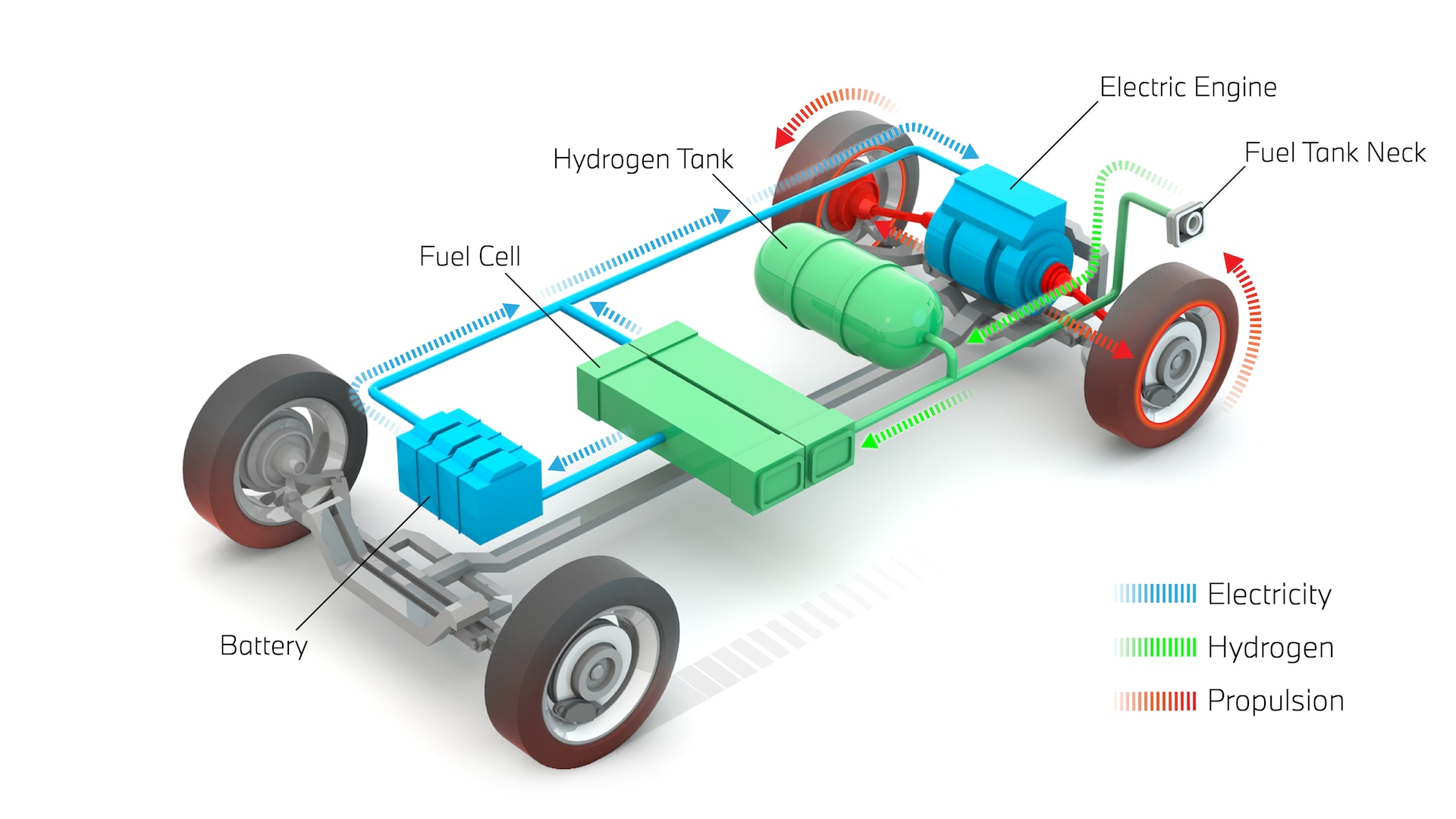

A hydrogen fuel cell vehicle resembles a battery electric car in many respects. Both use electric motors for propulsion and require no combustion engine. The key difference lies in how electricity is generated and stored onboard.

The heart of a fuel cell electric vehicle is the proton exchange membrane fuel cell stack, typically comprising hundreds of individual cells connected in series to generate sufficient voltage. Each cell contains three main components: an anode, a cathode, and the membrane electrolyte separating them. Hydrogen gas from onboard storage tanks enters at the anode side whilst air enters at the cathode.

At the anode, platinum catalyst particles split hydrogen molecules into protons and electrons. The protons pass through the membrane whilst electrons cannot, forcing them through an external circuit where they perform useful work—powering the electric motor, charging a small battery, running the air conditioning, operating the radio, and illuminating the lights. At the cathode, oxygen from the air combines with the arriving protons and electrons to form water vapour, which exits through the tailpipe as the vehicle's only emission.

Most fuel cell vehicles incorporate a battery of 20-100 kilowatt-hours capacity: much smaller than a pure battery electric vehicle. This battery smooths power delivery, captures regenerative braking energy, and provides extra acceleration when needed. During steady-state motorway cruising, the fuel cell supplies power directly. During hard acceleration, both fuel cell and battery contribute. When coasting or braking, the motor operates as a generator, returning electricity to the battery.

The fuel cell stack itself operates at relatively low temperatures between 60°C and 90°C, far cooler than an internal combustion engine. Thermal management remains critical—too cold and the catalyst performs poorly; too hot and the polymer membrane degrades. Sophisticated cooling systems using radiators, pumps, and control algorithms maintain optimal operating conditions regardless of ambient temperature or power demand.

Toyota's second-generation Mirai demonstrates the technology's maturity. The vehicle stores 5.6 kilogrammes of hydrogen in three carbon-fibre-reinforced Type IV tanks rated to 700 bar pressure. The fuel cell stack produces 128 kilowatts, supplemented by a 1.24 kilowatt-hour battery. Official range exceeds 400 miles, which is comparable to many diesel cars and superior to most battery electric vehicles. Refuelling takes roughly five minutes, matching petrol station experience.

Fuel cells convert roughly 60% of hydrogen's chemical energy into electricity, compared to 20% for petrol engines. Battery electric vehicles achieve 80% tank-to-wheel efficiency, but accounting for electricity generation and hydrogen production from renewable sources, the well-to-wheel comparison becomes more nuanced. Both technologies waste energy, just at different points in the supply chain.

Energy Portability and Range

Hydrogen's fundamental advantage lies in energy density. One kilogramme of hydrogen contains roughly 33.3 kilowatt-hours of energy, compared to 12.5 kilowatt-hours per kilogramme for diesel and just 0.15 kilowatt-hours per kilogramme for lithium-ion batteries even accounting for the entire battery pack's weight. This disparity grows more significant as vehicle size and required range increase.

A passenger car requiring 300 miles of range might carry a 75 kilowatt-hour battery weighing approximately 500 kilogrammes. The equivalent hydrogen system—tanks plus fuel cell plus small battery—weighs considerably less, perhaps 200 kilogrammes total including 5 kilogrammes of hydrogen. The weight savings matter less for small vehicles where battery electric makes perfect sense. For larger vehicles, the calculation shifts dramatically.

Refuelling speed provides hydrogen's second major advantage. Charging a 75 kilowatt-hour battery at a rapid charger requires 30-45 minutes minimum, often longer in cold weather or if multiple vehicles queue for limited chargers. Hydrogen refuelling mirrors the petrol station horror—pull up, connect the nozzle, wait five minutes whilst high-pressure gas flows into the tanks, disconnect, drive away. This convenience particularly matters for commercial vehicles where driver time costs money and tight delivery schedules permit no delays.

Range anxiety afflicts battery electric vehicle owners less than it did five years ago, but the problem hasn't disappeared entirely. Published range figures assume mild weather and gentle driving. Cold temperatures reduce battery efficiency dramatically—a vehicle rated at 300 miles might manage 200 miles in January with the heater running. Motorway speeds consume battery charge faster than city driving. Towing anything quickly drains the pack. Fuel cell vehicles exhibit similar efficiency variations but maintain full range since refuelling takes minutes rather than hours.

The cost equation currently favours battery electric vehicles substantially. Hydrogen fuel in California—the only American state with meaningful infrastructure—costs roughly $36 per kilogramme in 2024, up from $13 in 2022.

At that price, driving a Mirai costs significantly more than either petrol or electricity. The UK has even less infrastructure than California, making cost projections speculative. Civil service projections assume hydrogen production costs will fall to £2 per kilogramme by 2030, but achieving this requires massive scale-up of renewable electricity generation and electrolyser deployment.

Heavy Goods Vehicles End The Battery Argument

Battery electric cars work brilliantly for daily commuting and local errands. Battery electric lorries make considerably less sense, particularly for long-haul freight operations where payload capacity and minimal downtime determine profitability.

A battery pack capable of powering a Class 8 articulated lorry 500 miles requires roughly 1,000 kilowatt-hours of capacity—thirteen times larger than a Tesla Model 3's battery. At current energy densities around 4 kilogrammes per kilowatt-hour, this battery weighs approximately 4,000 kilogrammes (4 tonnes), occupying substantial volume and reducing cargo capacity dramatically. UK regulations limit total vehicle weight to 44,000 kilogrammes; every kilogramme devoted to battery reduces revenue-generating payload.

Hydrogen fuel cell lorries carry perhaps 100 kilogrammes of hydrogen in pressurised tanks, plus a 100 kilowatt-hour battery, plus the fuel cell stack and associated plumbing. Total drivetrain weight runs roughly 1,000 kilogrammes—three-quarters less than battery electric. This preserves cargo capacity close to current diesel vehicles, avoiding the crippling payload penalties battery electric imposes.

A megawatt-hour battery requires either hours on standard chargers or extremely high-power connections approaching megawatt levels. Installing megawatt charging stations requires substantial electrical infrastructure upgrades—transformers, cables, substations. Many motorway service areas lack sufficient grid capacity for even a handful of lorry chargers. Hydrogen refuelling infrastructure requires different but not necessarily more expensive investment.

Several manufacturers are developing hydrogen lorries. Hyundai's XCIENT Fuel Cell operates in Switzerland, having accumulated over 15 million kilometres across nearly 200 vehicles. The truck employs two 95-kilowatt fuel cells, a 350-kilowatt drive motor, and carries sufficient hydrogen for approximately 400 kilometres of range.

Nikola's TRE FCEV targets the American market with similar specifications. Daimler and Volvo are jointly developing fuel cell technology for heavy commercial vehicles, recognising battery electric works superbly for urban delivery vans whilst hydrogen makes more sense for intercity freight.

The National Renewable Energy Laboratory in America conducted simulation studies comparing battery electric and fuel cell lorries on typical long-haul routes. Fuel cell vehicles required five fewer stops and spent substantially less time refuelling compared to battery electric equivalents. The fuel cell lorry's flexibility—capable of both regional delivery and long-distance haulage—gives fleet operators more deployment options than battery vehicles limited by charging time and range constraints.

Fuel cell systems cost significantly more than diesel engines, though less than the massive battery packs required for comparable electric range. Hydrogen fuel costs exceed diesel currently, though this gap should narrow as production scales up.

Total cost of ownership analyses produce wildly varying results depending on assumptions about fuel prices, electricity costs, and infrastructure availability. Battery electric lorries will likely dominate short-haul urban routes; hydrogen appears better suited for long-distance freight.

Something the English are pretty good at fixing.

Hydrogen Planes and Boats

Aircraft and ships present even more acute challenges for battery technology, making hydrogen particularly attractive for these sectors despite formidable technical obstacles.

Aviation has flirted with hydrogen since the 1980s, but serious development efforts accelerated recently as the industry confronts pressure to decarbonise. ZeroAvia, a British-American company, flew a 19-seat Dornier 228 aircraft using hydrogen fuel cells in January 2023—the largest hydrogen-powered aircraft flight to date. The company is developing a 600-kilowatt fuel cell system for aircraft up to 20 seats, planning commercial operation by 2026. Longer-term plans envision 5-megawatt systems capable of powering 70-seat regional turboprops.

Airbus has committed to bringing a hydrogen-powered commercial aircraft to market by 2035, selecting fuel cell propulsion over hydrogen combustion after extensive research. The ZEROe programme envisions four electric propellers, each powered by separate fuel cell stacks, with hydrogen stored as cryogenic liquid at minus 253°C. The extreme cold creates unique engineering challenges—insulation must prevent heat leaking into the fuel tanks whilst lightweight construction remains essential for flight.

Hydrogen's energy density by weight exceeds jet fuel, but its volumetric energy density is far lower even when liquefied. A hydrogen-powered aircraft requires larger fuel tanks than conventional designs, necessitating significant airframe modifications. Regulators must develop entirely new certification standards for hydrogen aircraft, a process requiring years of testing and analysis. Infrastructure presents another hurdle—airports would need specialised equipment for handling, storing, and transferring cryogenic hydrogen safely.

Maritime applications face similar challenges with slightly more room for solution. Ships can accommodate large hydrogen tanks more easily than aircraft, and refuelling frequency matters less on routes spanning days rather than hours. Norway's MF Hydra ferry became the world's first liquid hydrogen passenger vessel in 2023, powered by two 200-kilowatt Ballard fuel cells. The ferry stores 4,000 kilogrammes of liquid hydrogen and operates emission-free.

Shipping lines are exploring both hydrogen fuel cells and ammonia—easier to store and transport than pure hydrogen. Ammonia must be "cracked" to release hydrogen or burned directly in modified engines, each approach carrying trade-offs. DNV, the maritime classification society, projects hydrogen and ammonia could comprise 60% of shipping fuel by 2050, though current adoption remains negligible.

Toyota Mirai and California Cautionary Tales

California's experience with hydrogen vehicles offers sobering lessons for the UK. The state aggressively promoted fuel cell vehicles, subsidising both car purchases and refuelling station construction. Toyota's Mirai became the poster child for clean transportation—a proper executive saloon producing only water vapour from the tailpipe, with 400 miles of range and five-minute refuelling.

The experiment has largely failed, not due to vehicle engineering but infrastructure inadequacy. California planned 200 hydrogen stations by 2025; only 54 exist currently. Shell closed all its hydrogen stations in early 2024. Stations frequently run out of fuel. Equipment breakdowns leave drivers stranded. Hydrogen nozzles freeze to vehicles in the extreme cold required for storage, turning five-minute refuelling sessions into hour-long ordeals. Drivers report travelling 50 miles or more searching for working stations.

Hydrogen prices tripled between 2022 and 2024, from $13 to approximately $36 per kilogramme. Toyota included $15,000 fuel credit with new Mirais, intended to cover "at least five years" of fuel. At current prices, this covers perhaps 18 months. Resale values collapsed—Mirais retain only 19.4% of original value after five years, making them terrible investments for buyers now stuck with essentially undriveable cars.

Multiple class action lawsuits now target Toyota, with owners alleging fraudulent misrepresentation and breaches of warranty. Plaintiffs claim dealerships assured them hydrogen infrastructure was robust and reliable when the opposite was true. Some owners still make car payments on vehicles they cannot fuel. The chaos has driven hydrogen vehicle sales down 70% in the first quarter of 2024 compared to the previous year.

Toyota recently offered staggering discounts on remaining 2024 Mirai inventory—the £50,190 XLE model dropped to £15,190, a 70% reduction. Even these desperate measures haven't cleared dealer lots. The technical excellence of the vehicles becomes irrelevant when supporting infrastructure doesn't exist.

The UK must learn from California's mistakes.

Government cannot merely subsidise vehicle purchases and hope infrastructure materialises. Private companies won't invest billions in hydrogen stations without guaranteed vehicle sales. Drivers won't buy hydrogen cars without reliable refuelling networks.

This chicken-and-egg problem requires, yuck, coordinated government intervention—mandating minimum station coverage, guaranteeing fuel supplies, ensuring station uptime, and perhaps operating stations directly until the market matures sufficiently for private handoff.

Natural Hydrogen: Britain's Underground Potential

The discovery of substantial natural hydrogen deposits worldwide has transformed the element from manufactured commodity to potential extractable resource. Britain's geological formations suggest significant reserves may exist, though exploration remains nascent.

Scotland's potential reserves span from Greenock in the west to Aberdeen in the northeast, following ancient geological structures where iron-rich rocks have interacted with groundwater over millions of years. The Lizard peninsula in Cornwall, known for ultramafic rocks, presents another promising formation. Shetland's unique geology and areas near Omagh in Northern Ireland complete the list of likely sites identified through preliminary analysis.

The Royal Society's 2025 report on natural hydrogen warned against "gold rush" mentality, emphasising the need for rigorous science. Whilst geological hydrogen certainly exists, questions remain about concentration, purity, extraction methods, and economic viability. A deposit containing millions of tonnes sounds impressive until one considers that extracting it requires drilling infrastructure, pipeline networks, and purification facilities—investments requiring certain returns.

Natural hydrogen formation occurs through several mechanisms. Serpentinisation, the reaction between ultramafic rocks and water, produces hydrogen most efficiently. Iron oxidation in sedimentary basins generates hydrogen more slowly but over vast areas. Radioactive decay of minerals can split water molecules, releasing hydrogen. The challenge lies in finding locations where geological conditions favour hydrogen accumulation rather than dispersal through permeable rock.

Extracting natural hydrogen should theoretically cost less than manufacturing it through electrolysis—no electricity input required, just drilling and distribution. Purity varies by deposit; some contain near-pure hydrogen whilst others require separation from methane, nitrogen, or carbon dioxide. The technology exists, adapted from oil and gas extraction, but regulatory frameworks don't. The UK lacks licensing procedures for hydrogen exploration, creating legal uncertainty deterring investment.

Several companies have begun early-stage exploration. Getech employs artificial intelligence to analyse geological databases, identifying optimal drilling locations. Gold Hydrogen and Koloma are pursuing similar strategies in Australia and America respectively, with Koloma securing substantial funding from investors including Bill Gates. The question isn't whether natural hydrogen exists but whether concentrations justify extraction costs.

Even if natural hydrogen proves economically marginal, the discovery of global deposits changes strategic calculations. Countries with exploitable reserves could produce truly low-cost hydrogen without renewable electricity constraints.

This could enable hydrogen export markets, with Saudi Arabia or Russia shipping hydrogen to nations lacking either renewable resources or natural deposits. The geopolitics of hydrogen may eventually rival oil, though that future remains decades away.

Won't It Blow Up?

Hydrogen's reputation as dangerous stems partly from the Hindenburg disaster, when a German airship exploded catastrophically in 1937. The spectacular newsreel footage embedded hydrogen's danger in public consciousness. Modern analysis suggests the airship's fabric coating burned more readily than the hydrogen lifting gas, but the association persists.

The gas burns readily in air concentrations between 4% and 75%—a far wider flammability range than petrol (1.4%-7.6%) or natural gas (5%-15%). Hydrogen ignites easily from static electricity or hot surfaces. Leaking hydrogen accumulates under ceilings and overhangs, creating explosion hazards in enclosed spaces. The flames burn invisibly, making fires difficult to detect and potentially dangerous for firefighters.

These hazards shouldn't be minimised, but hydrogen's properties also confer safety advantages. Being 14 times lighter than air, hydrogen disperses rapidly outdoors—leaks escape upward rather than pooling like petrol vapours. The wide flammability range paradoxically makes accidental detonation less likely; hydrogen quickly dilutes beyond explosive concentrations. When ignited, hydrogen burns rapidly upward and outward, often venting away from structures rather than consuming them.

Type IV tanks used in vehicles employ carbon-fibre wrapping around thin aluminium liners, rated to 700 bar pressure. Testing includes ballistic penetration—shooting the tanks with high-powered rifles—which typically creates controlled venting rather than catastrophic failure. Fire testing demonstrates thermal relief devices vent hydrogen through controlled flares before pressure builds dangerously. One liquid hydrogen tanker crash in California saw the glycerin truck driver killed whilst the hydrogen tanker remained intact, with only minor venting.

NASA developed comprehensive hydrogen safety guidelines through decades of rocket programme experience. The ghastly Health and Safety Executive oversees hydrogen installations in Britain, mandating sensor systems, ventilation, emergency shutdown procedures, and strict material specifications. Industrial users including chemical plants, refineries, and electronics manufacturers have safely handled hydrogen for generations.

Vehicle collision testing shows fuel cell cars perform comparably to petrol vehicles. In controlled crash tests, hydrogen tanks withstood impacts without rupturing. If ignition occurs, hydrogen flames typically burn away from the vehicle rather than engulfing it. Battery electric vehicles present different risks—lithium-ion battery fires burn intensely and prove difficult to extinguish, sometimes reigniting hours after apparent extinction. Each technology carries distinct hazards; none is perfectly safe, all can be managed through proper engineering and procedures.

People readily accept petrol's dangers—explosive vapours, toxic fumes, contaminated soil and groundwater—because familiarity breeds complacency. Hydrogen seems scarier because it's unfamiliar. Clear communication about actual risks, not sensationalism or dismissiveness, will determine whether the public embraces or rejects hydrogen vehicles and infrastructure.

Infrastructure Costs and Regulatory Bullshit

Building comprehensive hydrogen infrastructure across the UK requires staggering investment, coordinated planning, and regulatory frameworks barely beginning to take shape. Government projections suggest tens of billions of pounds needed by 2030 to establish even basic production, storage, transport, and distribution capabilities.

Well, if the government does it.

The 2021 UK Hydrogen Strategy set a target of 5 gigawatts of low-carbon hydrogen production capacity by 2030, later doubled to 10 gigawatts under the Energy Security Strategy. These targets encompass both electrolytic (green) and carbon-capture-enabled (blue) hydrogen. The government committed £240 million through the Net Zero Hydrogen Fund, with the first allocation round supporting eleven projects totalling 125 megawatts. A second round evaluating 87 applications for 2.8 gigawatts demonstrates industry interest, though actual deployment lags targets.

Production alone doesn't suffice—hydrogen requires storage and transport infrastructure.

The government – for some unknown reason – is developing business models for hydrogen transport and storage, with initial allocation rounds expected in 2025. The aim is supporting up to two large-scale geological storage projects and associated regional pipeline infrastructure by 2030. These initiatives mirror "carbon capture" transport (i.e. horses) and storage (i.e. trees) programmes, leveraging similar geological formations and existing pipeline corridors where feasible.

Repurposing existing natural gas infrastructure offers cost savings, though hydrogen's properties complicate direct conversion. The government commissioned studies on blending hydrogen up to 20% into the existing gas grid, potentially extending the utility of current pipelines whilst building dedicated hydrogen networks. Decision on gas grid hydrogen blending expected in 2026 will significantly impact infrastructure investment requirements.

The Energy Act 2023 provided a "legislative framework" for hydrogen business models but left many details unspecified. The Health and Safety Executive must develop comprehensive regulations covering everything from production safety to vehicle refuelling standards. The Gas Act 1986, written for natural gas, must be adapted for hydrogen's different properties. Planning permission processes for hydrogen production facilities, storage sites, and refuelling stations need streamlining.

Or we could not do any of this crap.

Communities near proposed hydrogen facilities cite safety concerns, traffic impacts, and visual intrusion. Some objections reflect legitimate planning considerations; others stem from insufficient understanding of actual risks. The UK lacks hydrogen literacy across the general population, making meaningful public consultation difficult when residents cannot distinguish real hazards from imaginary ones.

Producing significant quantities of green hydrogen through electrolysis demands enormous electricity supplies. A 1-gigawatt electrolyser operating continuously requires 1 gigawatt of constant power—equivalent to a large power station's output. This must come from renewable sources to justify the green hydrogen label, but renewable generation is intermittent. Massive renewable overbuild is required to ensure adequate electricity supply, or alternatively grid-scale storage to buffer renewable variability.

The National Energy System Operator will assume strategic planning responsibilities for hydrogen transport and storage infrastructure from 2026, bringing coordination but also bureaucratic complexity. Private companies must navigate multiple regulatory bodies, planning authorities, and government departments to advance projects. The process frequently takes years, deterring speculative investment.

All thanks to a ideology of the state monopoly over the risk-taking private sector.

Producing green hydrogen currently costs £4-6 per kilogramme; government projections assume this falling to £2 per kilogramme by 2030. Blue hydrogen produced at industrial scale with carbon capture might achieve £1.50 per kilogramme. Natural hydrogen, if exploitable, could drop below £1 per kilogramme. Whether these projections materialise depends on factors outside any single actor's control—renewable electricity costs, technological improvements, carbon price trajectories, and economies of scale as production increases.

Establishing a refuelling station network rivalling petrol stations requires hundreds of billions in investment. Each station costs approximately £1-2 million, sometimes more depending on capacity and location. Profitability requires sufficient vehicle throughput, but vehicles won't sell without station availability. The government has announced no comprehensive plan for mandating minimum station coverage or subsidising construction.

The contrast with battery electric vehicle charging infrastructure proves instructive. Installing electric chargers costs substantially less than building hydrogen stations, though high-power charging requires significant electrical upgrades.

More importantly, electric vehicle charging enjoys massive first-mover advantage—thousands of public charging points already exist, giving electric vehicles viable routes across Britain. Hydrogen starts from nearly zero infrastructure, making cold-start problems immensely harder.

Seawater To Freshwater & Hydrogen

The ultimate vision for hydrogen production involves direct transformation of seawater, simultaneously producing hydrogen fuel and desalinated freshwater. This dual output could transform both energy and water supply in coastal regions facing freshwater scarcity.

It's no understatement to say whomever masters this process in an energy-efficient way will rule the next few hundred years, because they would possess the ability to turn desert into forest.

Conventional hydrogen production through electrolysis requires ultrapure water—impurities below 10 parts per million to prevent catalyst poisoning and membrane fouling. Achieving this purity from seawater demands reverse osmosis or other energy-intensive desalination processes, typically adding 3-4% to production costs. Reverse osmosis plants operate at large scales, producing 10,000 to 1,000,000 cubic metres daily. The largest commercial electrolysers need only 125 cubic metres per day, creating a scale mismatch making dedicated desalination plants uneconomical for distributed hydrogen production.

Direct seawater electrolysis could bypass desalination entirely, but seawater's complex composition poses severe challenges. Chloride ions dominate, creating corrosion problems and competing with oxygen evolution at the anode. Calcium and magnesium ions precipitate at the cathode, forming scale deposits blocking catalyst surfaces. Marine bacteria and organic matter contaminate membranes. Trace metals poison catalysts.

The chlorine problem is particularly insidious. At anodes in saltwater, chloride ions oxidise to chlorine gas rather than water oxidising to oxygen. Chlorine evolution requires only slightly more energy than oxygen evolution, making separation through overpotential challenging. Chlorine is toxic, requiring containment and disposal. Chloride ions also attack electrode materials, corroding even stainless steel given sufficient time.

Surface engineering creates electrode structures repelling chloride whilst promoting oxygen evolution. Some catalysts employ hydrophobic coatings preventing chloride contact with active sites. Others utilise strongly basic local environments around electrodes, maintaining high pH where oxygen evolution is thermodynamically favoured over chlorine evolution. Protective outer layers of graphene oxide permit gas diffusion whilst blocking corrosive ions.

The cathode precipitation problem requires different solutions. Magnesium and calcium in seawater form hydroxides when alkalinity increases, creating solid deposits. Self-cleaning electrode designs periodically reverse polarity, dissolving accumulated precipitates. Continuous electrolyte flow removes precipitates before they accumulate critically. Some systems maintain acidic conditions at cathodes, preventing precipitation entirely whilst optimising hydrogen evolution kinetics.

Membrane innovations could enable practical seawater electrolysis. Phase-change migration systems exploit water vapour pressure differences, spontaneously transporting pure water from seawater to the electrolyte chamber through membrane pores whilst rejecting salts. Anion exchange membranes combine alkaline operation with commercial viability, suppressing chlorine evolution whilst using cheaper non-noble metal catalysts. Bipolar membranes generate strong acid-base gradients in situ, enabling unique electrochemical environments.

Economic analyses suggest direct seawater electrolysis could achieve hydrogen production costs around $1.96 per kilogramme assuming very cheap offshore wind electricity at $0.02 per kilowatt-hour. This compares favourably with conventional grey hydrogen and meets 2030 cost targets. Energy efficiency approximately 20% higher than conventional alkaline electrolysis provides further advantage. These projections assume successful commercialisation of current laboratory prototypes—far from guaranteed.

Every kilogramme of hydrogen produced requires splitting nine kilogrammes of water—if that water is seawater, desalination provides an additional benefit beyond energy production. Coastal cities could operate integrated facilities generating hydrogen for vehicles, industry, or power whilst supplying potable water. Islands lacking freshwater sources might prioritise water production, treating hydrogen as valuable byproduct rather than primary purpose.

Several demonstration projects are testing seawater electrolysis at scale beyond laboratory experiments. China's "Three Gorges Hydrogen Boat No. 1" operates on the Yangtze River using containerised hydrogen storage.

European projects are developing offshore wind installations with onboard electrolysis, producing hydrogen and fresh water at sea for transport ashore. If these demonstrations succeed technically and economically, seawater electrolysis could revolutionise hydrogen production in coastal locations globally, including substantial portions of the UK's island geography.

Why Aren't The World's Most Inventive People, The British, Building This?

Hydrogen's potential as a portable energy carrier remains immense. The element's energy density, rapid refuelling, and pollution-free use case create compelling advantages over battery electric technology for specific applications—long-haul freight, aviation, maritime transport, industrial processes. The challenge lies not in hydrogen's properties but in England's ability to build infrastructure supporting widespread adoption.

The UK government has committed to aggressive targets and allocated substantial funds toward hydrogen development, but implementation lags ambition. Regulatory frameworks remain incomplete and hold back yet the market. Production capacity falls far short of requirements. Transport and storage infrastructure barely exists. Refuelling stations number in single digits. Private investment awaits clearer policy direction and reduced risk.

Natural hydrogen discoveries offer potential shortcuts, allowing extraction rather than manufacture, but commercialisation remains speculative. Seawater electrolysis could simultaneously address water and energy needs, but technological hurdles prevent immediate deployment. Battery electric vehicles will dominate light-duty transport regardless of hydrogen progress, but larger vehicles requiring longer range and faster refuelling present opportunities where hydrogen excels.

California's infrastructure failures provide cautionary lessons. Building vehicles without supporting infrastructure serves no one. Hydrogen success requires coordinated rollout of production capacity, distribution networks, refuelling stations, and safety regulations before significant vehicle deployment begins. The UK must avoid repeating California's mistakes—underinvestment in infrastructure followed by disappointed consumers and collapsed markets.

The search for better portable energy from the universe's most abundant element continues, hampered by economics, infrastructure deficits, and competing technologies. Whether hydrogen fulfils its promise or becomes another technological dead-end depends on choices made over the next decade. The elements of success are visible—sufficient technical maturity, recognition of limitations, understanding of required investments. Whether government, industry, and consumers muster the will and resources to build hydrogen's future remains the unanswered question.