The British Universal Health Framework: A Gold Standard To Replace The NHS

Healthcare that compounds wealth for your grandchildren. Competition that ends waiting lists. Coverage that protects everyone absolutely. The Restorationist presents the Universal Health Framework: Singapore's savings discipline with European choice. Britain's third way.

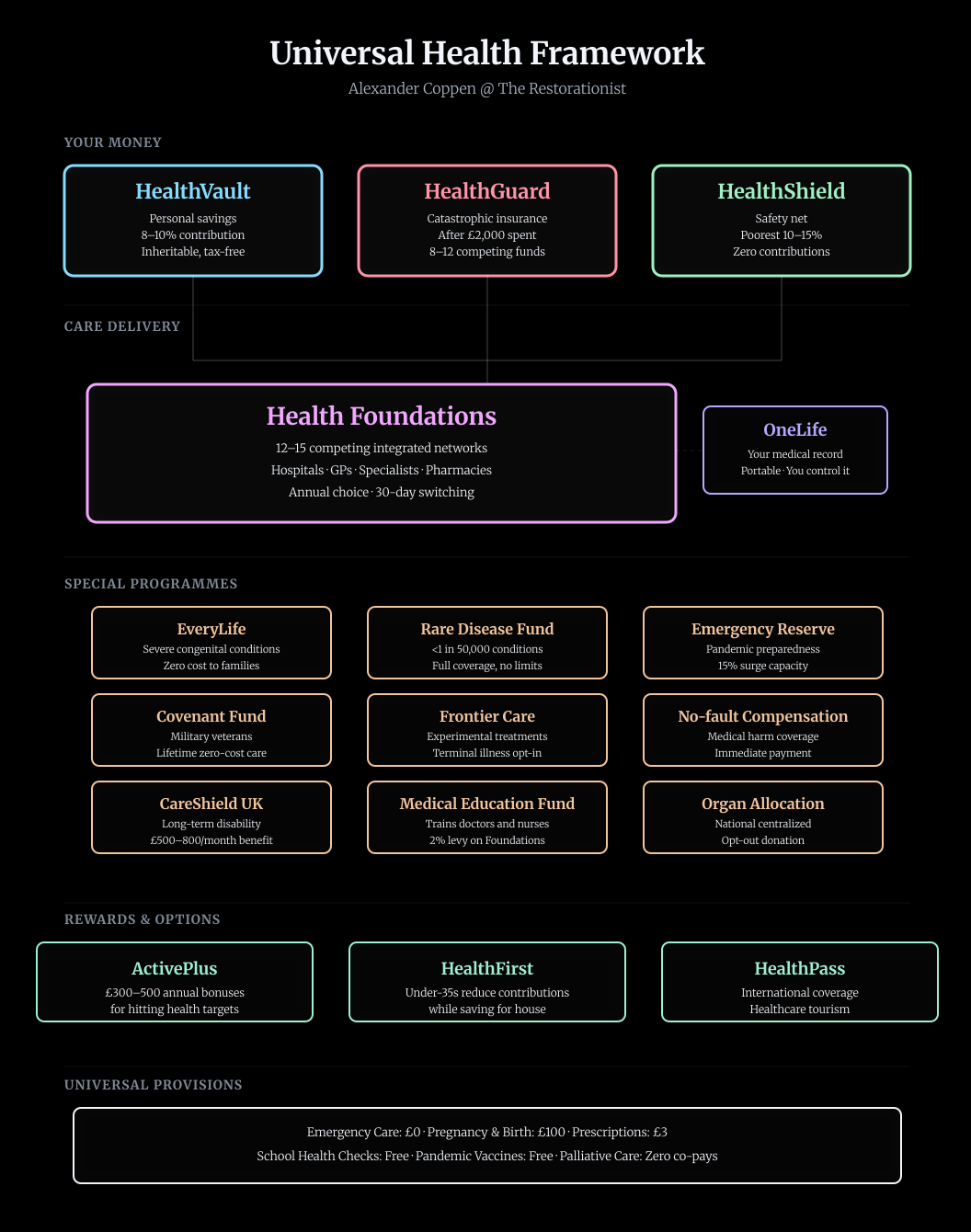

Picture three connected pots of money, each doing a different job. Together they replace everything the NHS does now, but they work completely differently.

Quick UHF Cheatsheet

Health systems are big. Before reading on, get familiar with these terms.

Personal Accounts

- HealthVault - Your personal health savings account. Grows tax-free, inheritable, pays for optional non-emergency care below £2,000 (appointments, prescriptions, etc.)

- HealthGuard - Catastrophic insurance. Covers everything after you spend £2,000 in a year. 8-12 competing funds to choose from.

- OneLife - Your complete zero-knowledge anonymised electronic medical record. You own it, control it, it follows you everywhere, or nowhere.

Care Providers

- Health Foundations - 12-15 competing hospital/GP networks instead of one big monopoly. You pick one annually, switch anytime if dissatisfied. Not one NHS, 12-15 different regional NHS-style non-profits you can choose to get service from.

Safety Nets & Special Programmes

- HealthShield - Covers the poorest 10-15%. Zero contributions, full care.

- EveryLife - Complete coverage for children born with severe conditions. Zero costs to families.

- Covenant Fund - Lifetime zero-cost care for military veterans.

- CareShield - Long-term disability insurance and elderly care for pensioners. Monthly payments if you can't care for yourself.

- National Health Emergency Reserve: for problems like Covid.

- Medical Education Fund: like it says.

- Rare Disease Fund: for conditions affecting fewer than one in 50,000 people.

- No-fault Compensation Scheme: immediate standardised compensation for harm caused by medical treatment, regardless of whether clinical negligence occurred

- Frontier Care: opt-in to experimental therapies if you're terminally ill.

Rewards & Options

- ActivePlus - Cash bonuses (£300-500/year) for hitting health targets.

- HealthFirst - Lets under-35s reduce contributions while saving for a house.

- HealthPass - Your coverage works abroad at approved providers; tourists can purchase healthcare from the UK.

HealthVault: Your Personal Health Account

Every month, 8% of your salary goes into an account with your name on it. Your employer adds another 2% for the first fifteen years, then you take over the lot. This money is yours. Not the government's. Not the NHS's. Yours.

HealthVault grows like any investment account. The default option tracks global stock markets through ultra-low-cost index funds—the same ones that have turned consistent savers into millionaires over working lifetimes. You can leave it on autopilot or manage it yourself if you prefer. Either way, it compounds tax-free for decades.

You spend HealthVault money on everything healthcare-related. GP appointments, prescriptions, physiotherapy, dental check-ups, new glasses, private surgery if you want it, even health insurance premiums. The money moves with a tap on your phone. Every provider—whether a Health Foundation running a hospital or a corner pharmacy—takes HealthVault payments. The infrastructure works like contactless payment but specifically for healthcare.

Here's the transformation: when you're 25 and healthy, spending perhaps £500 a year from HealthVault while contributing £4,000, your account grows fast. By 35 you might have £50,000. By 50, perhaps £120,000. By retirement, anywhere from £150,000 to £300,000 depending on how healthy you stayed and how well the markets performed.

That money passes to your spouse when you die. Then to your children. It becomes family wealth, not government spending that vanishes into thin air. Suddenly every pound you don't spend on healthcare becomes a pound your children inherit. The incentive structure flips completely.

Young people under 35 get a special option called HealthFirst. They can drop their contribution to 4% for up to five years while saving for a house deposit—but only if they hit basic health targets every quarter and keep their catastrophic insurance active. It's a recognition everyone starting out needs help with housing, but it comes with strings. You must catch up later, between 35 and 45, but by then you're earning more anyway.

The self-employed contribute 8% of their declared income. No employer to share the load, but also no employer to pay before you see the money. It smooths out in the wash.

HealthGuard: When Things Go Seriously Wrong

Nobody wants to think about cancer, heart attacks, or car accidents. HealthGuard exists for exactly these unexpected tragic moments.

Every year, once you've spent £2,000 from your HealthVault—roughly what someone with a chronic condition might spend, or what one moderately serious incident costs—HealthGuard takes over. After that threshold, everything is covered. Every test, every surgery, every night in hospital, every medication. No lifetime limits. No caps. No surprise bills. Complete coverage.

This costs about £80 a month, which comes straight out of your HealthVault before you see it, so it never touches your bank account. You're not paying it the way you pay rent; your HealthVault pays it automatically.

Here's where competition enters.

Eight to twelve not-for-profit organisations offer HealthGuard coverage. They're called funds, and they must accept everyone at the same price regardless of health status. Cannot cherry-pick the healthy. Cannot charge more for pre-existing conditions. Cannot refuse anyone.

These funds compete on service quality: how fast they process claims, how helpful their staff are, which Health Foundations they've negotiated good rates with, whether they cover overseas treatment readily. Every November you can switch funds. Takes thirty days. If thousands of people leave a fund because it's rubbish, the fund either improves or dies. The money follows you to whichever fund you choose.

The funds are mutually owned or structured as Community Benefit Societies. No shareholders extracting profit. Any surplus gets reinvested or rebated to members. Boards must include at least 30% patient representatives—actual users, not professional board-sitters. Administrative costs are capped at 5% of premium income. The regulations are simple: accept everyone, charge everyone the same, cover everything after £2,000, keep your paperwork lean.

Behind the scenes, funds make risk-equalisation payments to each other. If one fund happens to attract sicker members—perhaps they have a reputation for excellent cancer care—they receive money from the other funds to compensate. This stops any fund from having an incentive to avoid ill people. The maths balances every quarter based on actual risk profiles.

HealthShield: The Floor Nobody Falls Through

Some people live in Britain with nothing. Some people lose everything through circumstances beyond their control. Some people are born into poverty. HealthShield ensures they receive comprehensive healthcare anyway.

Nobody should ever die because they are poor.

If you're in the poorest 10% of the population, you contribute nothing to HealthVault and pay nothing for HealthGuard. Zero. The next tier up—from the 10th to 25th percentile—pays sliding scale contributions: perhaps £20 a month at most, often less. All co-payments are waived. You walk into care and receive it.

That's the price of living in a wonderful society and being a virtuous people.

The assessment happens automatically through tax records. No forms to fill out. No benefits office to visit. If you qualify, you qualify. HMRC knows your income; the system adjusts your contributions accordingly. When your circumstances improve, there's a six-month grace period before contributions increase. When they worsen, relief is immediate.

HealthShield costs about £30 billion annually—roughly 15% what the NHS costs taxpayers now. The difference is everything else is pre-funded through HealthVault and HealthGuard contributions. HealthShield only covers the genuinely poor and certain universal goods everyone receives regardless of income.

Which brings us to the universal provisions everyone gets for free, funded by HealthShield and available to anyone regardless of wealth:

- Emergency care. If you're brought into A&E after a car accident, you're not thinking about money and shouldn't have to. Ambulances, trauma centres, acute cardiac treatment, stroke care—all free at point of use. No bills. No questions. Just treatment.

- Pregnancy and birth. The entire episode from first scan to taking your baby home costs £100. That's a flat fee regardless of complexity. Caesareans, complications, extended stays—all covered. Britain needs more births, not fewer. Removing financial barriers to having children is population policy delivered through healthcare pricing.

- Children under 18 receive automatic HealthShield coverage under their parent's policy at no extra premium. If your household hits the £2,000 threshold, everyone's covered. Each child also gets a HealthVault opened at birth with a £500 government contribution to start their account growing early.

How You Actually Use the System

The morning your knee starts hurting, you open the UHF app on your phone. It shows your HealthVault balance—let's say £72,450—and this year's spending so far: £340 out of the £2,000 threshold. You haven't triggered HealthGuard yet.

You search for physiotherapists nearby. Eight options appear, showing prices: between £45 and £80 for an initial appointment. You read reviews written by actual patients. You see waiting times: one physio can see you tomorrow, three have next-week appointments, four are booking two weeks out.

You pick one, book an appointment, and the £60 fee reserves against your HealthVault. When you attend, you tap your phone against their reader—exactly like contactless payment—and the money moves. Receipt appears instantly. Your running total updates: £400 spent this year, £1,600 until HealthGuard activates.

The physiotherapist examines your knee and recommends an MRI scan to rule out cartilage damage. She gives you three options: the local Health Foundation's imaging centre (£400, booked three days out), a private clinic (£350, tomorrow afternoon), or a place in Poland that your HealthGuard fund pre-approves for £180 including flights if you want to make a weekend of it.

You book the private clinic for tomorrow. Your HealthVault balance adjusts. The scan comes back clear—just inflammation from overuse. The physio prescribes exercises and suggests two follow-up appointments if it doesn't improve. Total cost: £180 more.

Your total spending is now £740. Nowhere near the £2,000 threshold. You spend your own money, so you care about the price and quality. You read reviews. You compare options. You choose value.

Now imagine a different scenario: you're diagnosed with cancer.

Suddenly you're looking at £60,000 of treatment. Your HealthVault will cover the first £2,000. After that, HealthGuard pays everything.

You don't see bills for surgery, chemotherapy, radiotherapy, immunotherapy, supportive care, or the six-month recovery. Your HealthGuard fund coordinates everything with your chosen Health Foundation. The money flows between institutions. You focus on getting well.

The catastrophic cost is socialised through insurance. The everyday costs you manage yourself. This combination keeps overall spending low while eliminating financial fear from serious illness.

Health Foundations: Competition Instead of Monopoly

The NHS as a single national monopoly is finished. In its place, twelve to fifteen competing organisations called Health Foundations divide the country—but with overlapping boundaries so everyone has genuine choice.

Each Health Foundation operates like an integrated healthcare company. They run hospitals, employ GPs, operate diagnostic centres, contract with specialists, manage pharmacies, and coordinate everything between. If you need knee surgery followed by physiotherapy followed by a medication regime, one organisation handles the whole journey. No gaps. No bouncing between disconnected services.

You choose your Health Foundation once a year during November's open enrolment period. You can switch mid-year with thirty days' notice if you're unhappy. Perhaps you move house and prefer a different Foundation's facilities nearby. Perhaps your current Foundation has terrible waiting times. Perhaps you've heard the Foundation two towns over has brilliant cancer care. Whatever the reason, you can move. Your OneLife medical record moves with you electronically. Your HealthGuard fund adjusts who they're paying. Done.

Each Health Foundation receives a risk-adjusted capitation payment of roughly £2,000 per enrolled member per year from the HealthGuard funds. This covers everything above each patient's £2,000 threshold. They also receive direct HealthVault payments for care below the threshold. The Foundation's job is keeping you healthy and providing excellent care when you need it—doing this efficiently means they have money left over to reinvest in better facilities, newer equipment, and higher staff pay.

Health Foundations are legally structured as Community Benefit Societies or mutuals. They cannot have shareholders extracting profit.

Any surplus goes into reserves or gets reinvested in services. Boards include patient representatives. Annual accounts are published openly. You can read exactly where every pound goes.

The competition is designed to be transparent and useful. Every Health Foundation publishes real-time waiting times for common procedures, patient satisfaction scores, clinical outcomes for major conditions, and financial health indicators. If one Foundation consistently delivers hip replacements in three weeks while another takes four months, people notice and switch. The Foundation with four-month waits either solves the problem or loses members and revenue.

Because boundaries overlap geographically, you're never stuck. If you live in Birmingham, perhaps four Health Foundations serve your area. One might be strongest in cardiac care, another in cancer treatment, a third in orthopaedics. You pick based on what matters to you. If you're generally healthy, maybe you care most about GP accessibility and preventive care. If you have a chronic condition, you research which Foundation has the best specialist team for your needs.

Health Foundations make money by keeping people well. Every serious illness they prevent through good preventive care is money saved later. They therefore invest heavily in catching problems early, in supporting lifestyle changes, in managing chronic conditions tightly. The incentive structure finally points the right direction.

Procurement: How Small Firms Replace Giants

Within each Health Foundation, a quiet revolution transforms how things get bought. The old NHS loved enormous contracts with enormous companies. Capita, Serco, and other giants hoovered up billions for IT systems, facilities management, and outsourced services—often delivering badly while locking the NHS into decade-long contracts.

The Universal Health Framework flips this completely. Every Health Foundation must spend at least 40% of its non-clinical procurement budget with small and medium enterprises. Technology contracts cannot exceed £2 million without going out to competitive tender where local firms bid on equal terms. Explicitly favouring large providers is illegal.

In practice, this means the Derby Health Foundation looking for a patient appointment system speaks to software companies in Nottingham and Leicester before considering anyone else. The procurement process is streamlined: rather than 18-month tender processes with 400-page specification documents, there are fast track approvals where a small firm can pitch their product and go live within months if selected.

The incentive works both ways.

Health Foundations find they get better service from a local company with thirty employees who treat them as a major client than from a megacorp where they're account reference number 4,839. The local company customises quickly, responds to problems fast, and prices competitively because they're hungry for the business. Small firms find healthcare becomes a viable market rather than a closed shop.

The secondary effects matter too. A thriving ecosystem of health-tech companies emerges across British cities. Young companies solving workflow problems or building better diagnostic tools can now actually sell to healthcare providers without navigating procurement bureaucracy designed to exclude them. The best innovations get adopted quickly rather than dying in committee.

ActivePlus: Getting Paid to Be Healthy

Every year, you face six simple health targets. Hit four of them and money appears in your HealthVault. Hit all six and you can choose between extra HealthVault money or straight cash.

The targets are objective and measurable:

Body mass index below 30, or if you start higher, a 5% reduction from last year. Blood pressure below 130/80. Cotinine-negative test proving you don't smoke. Physical activity averaging 150 minutes of moderate exercise per week, tracked through your phone or smartwatch. HbA1c below 42 mmol/mol, which indicates your blood sugar is in the healthy range. Alcohol averaging below 14 units per week with liver function tests confirming no damage.

Four out of six targets hit: £300 bonus to your HealthVault. Five out of six: £400. All six: £500 and you choose whether it goes to HealthVault or your bank account. If you sustain five or six targets for five consecutive years, you receive a £1,000 bonus and a permanent reduction in your HealthGuard premium.

The Health Foundations fund these bonuses directly because you're saving them enormous money in future healthcare costs. Someone maintaining healthy weight, blood pressure, and blood sugar through their forties and fifties will likely cost 50-70% less to treat in their sixties and seventies. Paying £500 a year to secure those savings is obvious business sense.

The verification happens during annual health checks. You attend your chosen Health Foundation's wellness centre, spend 45 minutes getting basic measurements and blood tests, and everything is recorded in your OneLife record. The wearable data for physical activity syncs automatically from whatever fitness device you use—your phone if nothing else. The smoking test is a simple cotinine swab. The alcohol component combines your self-declaration with liver function markers from the blood test.

You can choose to participate or not. If you don't want any monitoring of your stats or check-ins, simply don't bother to opt in. Your data is yours, and stays confidential.

This is not punishment for being unhealthy. It's reward for being healthy. You don't lose anything if you miss targets. You simply don't gain the bonus. The psychological difference matters enormously. People respond well to rewards and badly to penalties for the same behaviour.

The regional dimension adds another layer. Every year, Britain's regions compete on aggregate health metrics: obesity rates, smoking prevalence, physical activity levels, cancer screening uptake, vaccination rates. The top-performing regions receive infrastructure investment bonuses—money for new facilities, upgraded equipment, expanded services. This creates positive peer pressure at the community level. Your neighbours doing well makes your area better.

HealthPass: Medicine Across Borders

Your HealthVault and HealthGuard work abroad. Not just in theory. Actually work, as easily as they work in Manchester.

The system pre-approves hundreds of hospitals and clinics across Singapore, Thailand, India, Spain, Poland, Germany, and Turkey. These facilities meet international quality accreditation standards. Their prices are published in pounds sterling. Their outcome data is transparent. You can book them as easily as you book UK providers.

Why would you go abroad for healthcare? Because a hip replacement in Poland costs £5,000 all-in while the same surgery in Britain might cost £15,000. Your HealthVault cares about this £10,000 difference because it's your money. Some of that saving stays in your account. You also get treatment faster—British waiting lists don't constrain you—and you might combine recovery with a holiday.

The Health Foundations care about this too. If thousands of their members are heading to Warsaw for orthopaedic surgery, either the Foundation improves its own service or it loses members. The competitive pressure works.

Your HealthGuard fund handles overseas claims identically to UK claims. Need cancer treatment at a specialist centre in Singapore with better outcomes than anywhere in Britain? If it's after your £2,000 threshold, HealthGuard covers it. The claim processes exactly the same way. Some funds actively contract with overseas providers, pre-negotiating rates and quality standards.

Medical tourism isn't some desperate escape valve. It's built into the system as a deliberate feature. Tens of thousands of Britons already travel abroad annually for healthcare—dental work in Hungary, surgery in Spain, fertility treatment in Cyprus. The Universal Health Framework simply formalises and expands what's already happening, adding quality assurance and payment infrastructure.

The flow works in reverse too. Foreign nationals can purchase HealthGuard coverage at 150% of standard rates and access British Health Foundations. Minimum one-year policies. Higher attachment point of £5,000 rather than £2,000. This generates revenue, fills capacity, and increases competitive pressure. Medical tourists coming to Britain for its excellent research hospitals or cutting-edge treatments pump money into the system without having paid in through HealthVault for decades.

For Britons temporarily abroad, reciprocal agreements with European countries, Singapore, Japan, South Korea, Australia, and New Zealand mean emergency care works seamlessly. Non-emergency treatment requires pre-approval from your HealthGuard fund, but they process these requests within 48 hours. Long-term expatriates can maintain HealthVault contributions for up to ten years while living abroad, ensuring immediate coverage when they return.

OneLife: Your Complete Medical Story

Every test result, every prescription, every surgery, every GP note, every hospital admission—your entire medical history lives in one secure, anonymised, zero-knowledge digital record called OneLife. You own it. You control who sees it. It follows you everywhere.

The record does not have your name or details on it, because it uses zero-knowledge cryptographic proofs. Only you can identify it, and only you can unlock it.

When you visit a new GP, they scan a code on your phone and instantly see your full history. They know what medications you're taking, what allergies you have, what conditions you've been treated for. No more repeating your medical history at every appointment. No more medication conflicts because one doctor didn't know what another prescribed.

Switch Health Foundations? Your OneLife record transfers electronically in real time. The new Foundation's systems import everything you allow them to. Your new doctors see the same complete picture your old doctors saw, if you allow them to.

The security is absolute. Patient-controlled access means nobody sees your medical data without your explicit permission. Even in emergencies, the access is logged and auditable. Government cannot access OneLife records without a court order. Police cannot access them. Employers cannot access them. Insurance companies outside the HealthGuard system cannot access them.

You can grant research permission if you choose. Tens of thousands of people opt into data sharing because they want their medical history helping advance treatment for conditions they or loved ones have faced. In return, they receive £100 annually in their HealthVault. The data is anonymised but linkable to outcomes, allowing researchers to track what treatments work long-term. This is entirely voluntary. You can withdraw permission any time.

The technical infrastructure is decentralised. No single database contains everyone's records. Each person's OneLife exists across multiple secure nodes. Even a massive breach could only compromise a fraction of records, and the encryption means stolen data is useless. Patient control is embedded at the architectural level, not just policy level.

Pricing Transparency: The End of Mystery Bills

Walk into any Health Foundation facility and you can know the price before receiving treatment. Common procedures have published rates. Uncommon procedures require a good-faith estimate within 48 hours. Surprise billing is illegal.

GP consultations typically cost £15-25. Specialist consultations run £50-150 depending on complexity. Routine blood tests might be £30-60. X-rays around £50-80. MRI scans £300-500. A straightforward surgical procedure before you hit the £2,000 threshold might be quoted at £800-1,200.

These prices vary between Health Foundations and between providers within each Foundation's network. Competition keeps them reasonable. If one Foundation starts charging £200 for a GP appointment, their members defect rapidly to Foundations charging £20. The market clearing price settles where supply meets demand, with the constraint that providers must publish prices clearly.

Once you've spent £2,000 in a year, you stop caring about prices because HealthGuard is paying. This is by design.

Catastrophic costs shouldn't force you to price-shop between surgeons during a medical crisis. But it also means only 10-15% of the population hits the threshold in any given year. The other 85-90% are spending their own HealthVault money and care very much about prices.

Prescription medications cost £3 per item or nothing if you pay from your HealthVault balance. This tiny friction prevents mass over-prescription while keeping medications essentially free. Generic drugs dominate because they're cheapest. Brand-name drugs must justify their premium through actual superior effectiveness.

Dental check-ups run £20-40, optical examinations £20-30. Both are HealthVault-eligible, making them effectively free if you're managing your account well. Cosmetic dentistry and elective optical procedures aren't covered by HealthGuard after the threshold, but you can use HealthVault money if you choose.

Lifestyle Attribution: When Choices Have Consequences

Smoke for forty years, develop lung cancer, and the treatment costs £50,000. Under the old NHS, those costs vanished into general taxation. Under the Universal Health Framework, you face consequences—measured, fair, but real.

Certain conditions strongly linked to lifestyle choices attract a 50% co-payment from your HealthVault for the first episode. Smoking-related illnesses like lung cancer or chronic obstructive pulmonary disease. Alcohol-related liver disease. Obesity-related conditions requiring surgical intervention. Type 2 diabetes complications where lifestyle factors are documented contributors.

Don't do the crime if you can't do the time. It's common sense. Nobody else should have to pay for your bullshit, and you know it.

An independent clinical panel—not your treating physician—determines whether lifestyle attribution applies. They have access to your anonymous OneLife record and apply published, transparent criteria. You can appeal their decision with a patient advocate supporting you at no cost. Genetic testing is available to exclude hereditary factors. The process is medical, not moral.

Why the panel? Because you will probably try to take the piss.

Critically, this only applies to the first episode. If you develop lung cancer from smoking, receive treatment, and then five years later develop cardiovascular disease also linked to smoking, the second condition is covered normally. The system assumes you've attempted to change behaviour after the first wake-up call. It's not interested in lifelong punishment.

Mental health support is offered alongside any lifestyle attribution. Addiction is treated as a medical condition. But personal responsibility is taken seriously. If you choose to smoke despite knowing the risks, you bear more of the cost when those risks materialise.

Certain things remain fully your responsibility financially and never touch the common pool. Elective abortion on demand—not for medical necessity, rape, or incest, which are covered—is paid from HealthVault or private funds. Cosmetic procedures. Experimental treatments without evidence base. Alternative medicine without proven efficacy. These are personal choices you fund personally.

The principle: the social insurance model works when people are mutually insuring against unavoidable risks.

Cancer that strikes randomly. Accidents. Genetic conditions. Infectious diseases. Everyone pays in because everyone might need care. But deliberately assumed risks—smoking, drinking to excess, remaining obese despite knowing the consequences—deserve different treatment. You're still covered. You're not abandoned. But you pay a larger share, for taking the piss.

HealthFirst: The Young Person's Pathway

At 23, with your first proper job, healthcare contributions feel like a distant irrelevance. You're healthy. You might see a doctor once a year. Meanwhile, saving £30,000 for a house deposit feels impossible on £28,000 a year.

HealthFirst acknowledges this reality. For up to five years, if you're under 35, you can reduce your HealthVault contribution from 8% to 4% of salary. The difference must go into a Lifetime ISA or house-deposit account—you can't just spend it. Your catastrophic HealthGuard coverage remains fully active. You're still insured against serious illness. You simply contribute less to your health savings during the years you're saving for a house.

The conditions are straightforward. Every quarter, you must hit four out of six ActivePlus wellness targets. The standards are the same but measured quarterly rather than annually. Miss your targets one quarter and you get a warning. Miss two quarters and you're kicked out of HealthFirst back to standard 8% contributions.

Between 35 and 45, you catch up through slightly higher contributions. The maths balances over your working life. By the time you're 50, your HealthVault is where it would have been anyway, but you bought a house at 28 instead of 33.

About 40% of under-35s use HealthFirst. The rest either don't need it—perhaps they inherited money or partnered with someone who bought a house already—or they value building their HealthVault balance early over housing deposit acceleration. It's a choice, not a requirement.

That's the key – choice. You can choose how your money works and what to do with it.

The wellness target requirement is crucial. HealthFirst isn't a free pass to neglect your health during your twenties. The system needs you staying healthy now to avoid expensive conditions later. The quarterly check-ins keep you engaged with basic health metrics during the exact years many people's habits set for life.

EveryLife: Children Born Facing Mountains

Some babies arrive needing everything modern medicine can offer just to survive. Complex congenital heart disease. Severe cerebral palsy. Metabolic disorders so rare they lack names most people recognise. These children face lifetimes of intensive medical care.

EveryLife exists for them. It's a promise: every life has equal value regardless of length, and no child is born outside the circle of care.

When a baby receives an EveryLife designation—determined by clinical panels within 30 days of diagnosis, provisional coverage starting immediately—several things happen at once.

The child's HealthVault opens with £50,000 deposited by the government. Every year until age 18, another £20,000 arrives. This money pays for anything the family needs: specialist equipment, home modifications, private therapies not covered elsewhere, vehicle adaptations, anything that improves the child's quality of life or reduces family burden.

The child's HealthGuard threshold drops to zero. No attachment point. Everything is covered from the first pound. All medications, even experimental treatments if their doctors approve them. All procedures. Home nursing care if needed 24/7. Respite care up to four weeks yearly. International treatment at world-leading centres, including travel and accommodation for the child plus two parents. Palliative and end-of-life care when the time comes. Family bereavement counselling for six months after death.

A dedicated EveryLife Navigator is assigned to each family. This professional coordinates every appointment, handles the paperwork, advocates with providers, connects families to support groups and charitable grants, and is available 24/7 for crisis support. No parent of a severely disabled child should have to become a medical administrator on top of being a parent.

If a parent must reduce work hours or stop working entirely to provide care, their HealthVault contributions continue at their full-time rate. The subsidy covers 80% of pre-diagnosis salary for one parent until the child turns 18 or dies. No means testing. The logic is simple: if your child requires constant care, you shouldn't face financial ruin for providing it.

If the child survives to 18, the HealthVault balance transfers to their name. Many EveryLife children live full adult lives—perhaps with ongoing needs, perhaps not—and that accumulated balance gives them a financial foundation. If the child dies, the unused balance splits between siblings' HealthVaults, with £20,000 going directly to the parents as recognition of their years of care.

EveryLife costs about £6 billion annually. It's funded through a 0.5% levy on all HealthGuard premiums—everyone contributes a tiny amount—plus a direct Treasury grant plus voluntary donations. The money is ring-fenced. It cannot be raided for other purposes.

Why does this exist in a system built around personal responsibility? Because babies don't choose their conditions.

Parents don't choose to have children with catastrophic medical needs. These are the blameless cases where society's commitment to universal care means something real. EveryLife demonstrates the system has a soul, not just a spreadsheet.

Siblings of EveryLife children automatically receive ActivePlus bonuses at 150% of standard rates. Growing up with a severely disabled brother or sister creates stress and challenges. The system acknowledges this through higher wellness rewards.

The Covenant Fund: A Nation's Promise to Those Who Serve

Military personnel occupy a unique position. They cannot refuse dangerous assignments. They go where ordered, face what comes, and accept risks most people never contemplate. When they're injured—physically or mentally—the nation's obligation is absolute.

Active duty servicemembers contribute nothing to HealthVault. Military service itself is the contribution. Instead, the government opens a HealthVault for each servicemember on enlistment, deposits £10,000, and adds £2,000 for every year of service. This money grows tax-free and is inheritable. Twenty years of service means £40,000 plus decades of compound growth.

All healthcare for active military personnel comes through a separate military medical system designed for operational readiness. No costs. No questions. Their spouses and children receive full HealthShield coverage during deployments at zero cost.

Upon honourable discharge, servicemembers enter the Veterans' Covenant—lifetime healthcare coverage with zero attachment point for any condition, whether service-related or not. No HealthVault contributions required. No HealthGuard premiums. They simply receive care when needed.

Combat veterans receive additional benefits beyond the standard Covenant. Prosthetics and adaptive equipment without limit—whatever technology exists, they receive it. Complete home and vehicle modifications. Service dogs fully covered. Annual wellness retreats. Family counselling included. The best the system can provide.

Mental health support for veterans is unlimited. No session caps. No waiting lists. Specialised trauma and PTSD care delivered by clinicians who understand military culture. Veterans can access this immediately, any time, for the rest of their lives.

All veterans receive priority scheduling at every Health Foundation. They're not waiting months for appointments while civilians get seen. The care system recognises their service through immediate access.

The Covenant Fund runs separately from general HealthShield money. It receives a 0.5% levy on all HealthVault contributions—another solidarity payment everyone makes—plus a £6 billion annual Treasury grant plus voluntary donations. The fund is administered by an independent Veterans' Healthcare Trust with veterans on the board.

This is not socialism. It's earned. The nation asked them to risk everything. The nation then provides everything healthcare-related for life. Non-negotiable.

Pregnancy and Birth: Removing Every Barrier

The entire journey from positive pregnancy test to bringing your baby home costs £100. That's everything: scans, midwife appointments, delivery, complications, caesarean if needed, extended hospital stay, postnatal care.

Britain's fertility rate is 1.56 children per woman. To keep the population stable requires 2.1. The gap means economic trouble ahead: fewer workers supporting more retirees, slower growth, diminished dynamism. Every advanced economy faces this challenge. Most throw money at the symptom through pension adjustments. The Universal Health Framework attacks a cause.

Making pregnancy expensive or even moderately costly discourages births, especially among working and middle-class families where a few thousand pounds matters. Making it effectively free removes a barrier without making it actually free—the £100 fee is a token, a psychological placeholder that keeps it from being "just another government service."

If complications arise, HealthGuard covers everything above £100. Twins? Same £100. Premature birth requiring weeks in NICU? Same £100. Emergency caesarean? Same £100. The catastrophic coverage activates immediately because pregnancy isn't a lifestyle choice the system discourages.

Children born in Britain to at least one British or permanent-resident parent automatically receive citizenship and the HealthVault £500 starting balance. The child's life begins with healthcare security.

Fertility treatment receives limited coverage: one full IVF cycle through HealthVault for married women under 40 with documented medical infertility. Additional cycles are on you. This balances helping those facing medical barriers to conception while acknowledging fertility treatment is expensive and can't be unlimited.

Foreign Nationals: Care and Consequences

A French tourist has a heart attack in London. The ambulance arrives within eight minutes. The paramedics stabilise him. The hospital performs emergency angioplasty, inserts a stent, and keeps him three days in cardiac care. He receives world-class treatment without a moment's consideration of payment.

The bill goes to the French embassy.

Under reciprocal agreements with EU countries, the British government invoices France's healthcare system. France pays within 30 days. The tourist never sees a bill. The system handles it government-to-government.

This extends to dozens of countries: the EU, Switzerland, Norway, Australia, New Zealand, Singapore, Japan, South Korea, Canada. Emergency care happens instantly. The paperwork follows.

For tourists from countries without reciprocal agreements, the same process applies with a different destination: the embassy of their home country receives the bill within 48 hours. That government is expected to pay. If they don't, diplomatic consequences follow: visa restrictions, trade complications, debt collection through international channels.

The principle is clear: emergency care is never withheld, but someone pays. Usually that someone is the tourist's home government, not British taxpayers. The tourist experiences seamless care. The bill gets handled at diplomatic level.

Foreign nationals residing in Britain—students, workers, anyone here long-term—can participate in the Universal Health Framework by purchasing HealthGuard coverage at 150% of standard rates. They don't have decades of HealthVault contributions, so they pay a premium reflecting this. They choose a Health Foundation, receive a OneLife record, and access the system like anyone else. Many do this happily because it's still cheaper and better than alternatives.

Medical tourists intentionally coming to Britain for specific treatments can buy one-year minimum HealthGuard policies. Higher attachment point of £5,000 rather than £2,000. Full coverage after that. This generates revenue and fills capacity. A wealthy individual from Nigeria coming to London for cardiac surgery at a centre of excellence contributes to the system's sustainability.

Asylum cases receive emergency stabilisation only. The embassy of their claimed country of origin receives the bill regardless of the asylum claim's validity. If they're granted asylum, they transition immediately to full HealthShield coverage. If denied, coverage ceases and deportation proceeds. The system doesn't reward destroying your passport to avoid identification.

Illegal immigrants receive stabilisation treatment for immediate life-threatening conditions, nothing more. They're reported to the Home Office simultaneously with treatment. Costs are billed to the embassy of their presumed origin. Deportation begins while treatment continues. The system doesn't become an incentive for illegal entry.

Birth tourism—foreign nationals deliberately coming to Britain to give birth—requires the mother to have either purchased a HealthPass minimum twelve months prior, or provided an embassy payment guarantee, or paid upfront. The fee ranges from £5,000 to £15,000 depending on expected complexity. Babies born to tourists without payment or guarantee remain foreign nationals. No automatic citizenship. Birth tourism prosecuted as immigration fraud.

Pregnant women from countries without reciprocal agreements who have paid nothing and whose embassies won't guarantee payment are transferred to their embassy for repatriation before delivery. Britain doesn't provide free maternity care to the world.

Abuse and Addiction: The Limited Safety Net

A 38-year-old heroin user overdoses in a Manchester park. Paramedics arrive with naloxone. They reverse the overdose. He survives.

The treatment is covered under emergency care. Stabilisation costs nothing to him and his family. But ongoing addiction treatment operates differently from standard healthcare.

Substance abuse treatment receives basic HealthShield coverage only. Emergency overdose reversal is always covered—saving lives is non-negotiable. But voluntary treatment for addiction follows restricted pathways: one 28-day residential detoxification program per year maximum, basic generic maintenance prescriptions like methadone or buprenorphine at £3 co-pay, group therapy only with no individual sessions.

Residential rehabilitation beyond basic detox is not covered. If you want three months in a private rehab facility, you pay from savings, family help, or charitable programs. Counselling is group-based. The system provides a pathway out of addiction but doesn't fund premium treatment indefinitely.

Why? Because addiction follows from choices made repeatedly over time. The first use is a choice. The second is a choice. Eventually addiction takes over and choice becomes complicated, but the path to addiction involved decisions. The system provides help—real help, including medication-assisted treatment proven effective—but doesn't treat addiction identically to cancer or accidents.

Harm reduction receives minimal public health funding: needle exchanges to prevent HIV transmission, overdose prevention sites in cities with severe heroin problems, naloxone widely available. These cost little and save both lives and money. But housing addicts, feeding them, and providing unlimited premium treatment isn't the system's job.

If someone maintains sobriety for 12 months and demonstrates recovery through participation in support programs, they transition back to standard HealthVault and HealthGuard participation. Recovery is rewarded. Active addiction receives basic support only.

Alcohol-related illness follows similar logic. First episode of alcohol-related acute pancreatitis receives standard coverage. Show up drunk repeatedly, and you get basic stabilisation plus referral to alcohol services. If you need a liver transplant from decades of drinking, you qualify only after 12 months of documented sobriety plus psychological assessment confirming commitment to recovery.

Mental Health: Full Parity With Physical Health

Depression costs £25 per counselling session from your HealthVault. Cognitive behavioural therapy for anxiety is £50-80 per session depending on provider and therapist seniority. Psychiatric consultations for medication management are £80-120. Once you've spent £2,000 in a year, HealthGuard covers everything exactly as it would physical conditions.

This is mental health parity: the idea mental illness deserves equal treatment to physical illness under insurance coverage. Many systems claim parity but bury mental health under restricted networks, session limits, and higher co-pays. The Universal Health Framework delivers actual parity.

If you develop severe depression requiring intensive outpatient therapy three times weekly, that's expensive. Your HealthVault covers initial costs. Once you hit £2,000, HealthGuard takes over indefinitely. If you need psychiatric hospitalisation, it's covered the same way as medical hospitalisation. If you need years of ongoing therapy plus medication, it's all covered after your threshold.

Dedicated mental health Health Foundations can exist as specialists. They operate identically to general Health Foundations but focus entirely on mental health services: therapists, psychiatrists, inpatient units, crisis stabilisation. You can choose a mental health specialist Foundation during open enrolment if mental health is your primary need.

Crisis care is included in free emergency provision. Someone threatening suicide gets immediate crisis intervention at no cost. The emergency mental health response works exactly like emergency physical response.

Severe mental illness cases—schizophrenia, severe bipolar, treatment-resistant major depression—receive care coordinators just like EveryLife children. These patients often can't navigate the system independently. The care coordinator handles appointments, ensures medication adherence, and advocates for services.

The one caveat: psychodynamic therapy or psychoanalysis stretching across years without objective improvement goals doesn't receive indefinite coverage.

Evidence-based meical therapies with measurable outcomes—CBT, DBT, exposure therapy—are covered fully. Therapies that amount to open-ended talking for years fall into elective personal growth, which is your money to spend but not the insurance system's responsibility.

Long-Term Care and Disability: CareShield

At 58, you have a severe stroke. You survive but lose significant function. You'll need daily assistance with basic activities for the rest of your life. The medical treatment is covered under HealthGuard. But who pays for the years of supportive care you'll require?

CareShield is mandatory long-term care insurance, starting at age 30. It costs £20 per month, paid from your HealthVault. If you become severely disabled—unable to perform at least three activities of daily living without help—CareShield pays a monthly cash benefit between £500 and £800 for life.

This money isn't healthcare payment. It's income replacement and care funding. You use it to pay for home care assistants, nursing home fees, adaptive equipment, whatever you need. It's yours to spend on your care however works best.

The benefit starts immediately upon qualifying. No waiting period beyond the clinical assessment confirming you meet the disability threshold. It continues for life, even if you outlive your predicted life expectancy.

Like HealthGuard, multiple competing providers offer CareShield coverage. You choose your provider. They all must accept everyone at community rates. They all pay the same statutory benefits. They compete on service quality and how smoothly they handle claims.

For people in the poorest income brackets covered by HealthShield, CareShield premiums are subsidised or waived. The benefits remain the same. Nobody becomes destitute from severe disability.

The system separates medical care from supportive care cleanly. Your Health Foundation handles medical needs. Your CareShield benefit handles daily living needs. They coordinate through your OneLife record but remain distinct.

Rare Diseases: The Specialisation Pool

When only 200 people in Britain have your condition, standard market competition breaks down. No Health Foundation has enough patients to maintain expertise. No drug company invests in treatments. You're medically orphaned.

The Rare Disease Fund exists within HealthShield specifically for conditions affecting fewer than one in 50,000 people. If you have such a condition, everything is covered regardless of cost. No attachment point. No limits. Full coverage from first pound to last.

Treatment happens at designated national specialist centres. These centres contract with the Rare Disease Fund and receive full funding to maintain expertise in ultra-rare conditions. They collaborate internationally because even pooling Britain's cases might mean five patients per year.

International treatment is standard for rare diseases. The UK might not have any centre experienced with your condition, but Boston or Munich or Singapore might. The Rare Disease Fund covers travel, accommodation, and treatment. The goal is getting you to expertise wherever it exists.

Drug costs for rare diseases are negotiated centrally. Pharmaceutical companies love charging seven-figure sums for rare disease treatments. The system refuses. Either you price reasonably or we'll import from countries where you've priced reasonably. Patent abuse triggers compulsory licensing. The rare disease patient isn't held hostage to pharmaceutical profit-seeking.

Organ Transplantation: Centralised Where It Must Be

Organ allocation cannot be competitive. When a compatible kidney becomes available, it must reach the best-matched patient within hours. Competition and patient choice don't work here.

The National Organ Allocation Service remains centralised, operated by an independent body funded through levies on all Health Foundations proportional to transplants their patients receive. The algorithms determining allocation are transparent and medically based. No gaming the system. No private markets in organs—buying and selling remains criminal.

Living donors have all expenses covered by the recipient's HealthGuard fund. If you donate a kidney to your sibling, your medical costs, recovery costs, lost wages, and follow-up care are all covered through their insurance.

Britain maintains opt-out organ donation: everyone is a donor unless they specifically register otherwise. This has increased available organs substantially. The system respects those who opt out but defaults to donation, recognising most people support donation but never get around to registering.

Palliative and End-of-Life Care

A terminal cancer diagnosis arrives. If you want every possible treatment until the end, that's your choice and HealthGuard covers it. But if you prefer focusing on quality rather than quantity, palliative care is fully covered with zero co-pays.

Hospice care is included after the £2,000 threshold. Home hospice with visiting nurses and equipment costs nothing to you. Inpatient hospice for pain management and end-stage care is covered. Bereavement counselling for family members continues for six months after death.

Charitable hospices—there are dozens across Britain doing extraordinary work—contract with Health Foundations and receive full payment for services. The system doesn't replace them; it ensures they're funded sustainably rather than constantly fundraising.

You can specify palliative care preferences in your OneLife record. If you're cognitively intact and choose to refuse life-extending treatment in favour of comfort care, those instructions are binding. Your family cannot override them. The system respects patient autonomy even when outcomes are fatal.

Education and Research: The Knowledge Pool

The NHS currently funds the training of every British doctor and nurse through direct payments to medical schools and teaching hospitals. The Universal Health Framework maintains this through a 2% levy on every Health Foundation's capitation payments.

The money pools into a Medical Education Fund distributed competitively to medical schools, nursing programs, and teaching hospitals. If you're a teaching hospital offering clinical placements, you bid for education funding. The best programs receive the most money.

Research funding operates similarly: competitive grants from a portion of the health levy. British medical research has produced extraordinary advances. The system ensures this continues by maintaining funding streams independent of commercial interests.

Academic medical centres can register as specialist Health Foundations focused on research-intensive care. They receive standard capitation plus education and research grants. Patients choosing these Foundations get care entwined with cutting-edge research and teaching.

Clinical trials continue with network cooperation. If you're enrolled in a trial, your HealthGuard fund and your Health Foundation coordinate to ensure trial participation doesn't create financial barriers or access problems.

International research collaboration continues unchanged. British researchers partner with colleagues globally. The funding model changes but the collaborative culture doesn't.

Pandemic Preparedness: The Reserve Capacity

COVID-19 taught brutal lessons about surge capacity. When demand suddenly quadruples, systems designed for normal times collapse. The Universal Health Framework builds pandemic preparedness into steady-state operations.

Every Health Foundation must maintain 15% surge capacity in beds, staff, and equipment. This isn't slack; it's insurance. Normally this capacity is used for elective procedures, reducing waiting times for non-urgent care. During emergencies, it converts to critical care.

The Health Standards Authority maintains a National Health Emergency Reserve: stockpiled ventilators, PPE, medications, testing equipment. This isn't centralised provision. It's strategic reserve released to Health Foundations when needed.

During declared national health emergencies, the system adapts: boundaries between Health Foundations temporarily blur, allowing patient flow to wherever capacity exists. Networks share resources. The regular competition pauses. Emergency powers permit temporary central coordination.

Vaccination programs during pandemics are voluntary and free at point of use, treated as public health goods. The infectious disease dynamic is different from standard healthcare—your vaccination protects others as much as yourself. The system recognises this through zero-cost universal provision.

After emergencies, the system returns to normal competitive operation automatically. Emergency powers expire without exception. Boundaries reassert. Competition resumes. The adaptive capacity is temporary by design, preventing emergency justifications from becoming permanent expansions of central control.

Children: From Birth To Eighteen

Your child is born. Their OneLife record opens automatically. A HealthVault gets £500 from the government to start growing. They're covered under your HealthGuard policy at no additional premium. Family attachment point of £2,000 per person caps at £6,000 per household—if you have three children and one has significant medical needs, you're not paying four separate thresholds.

Paediatric care works through the normal system. Your chosen Health Foundation provides GP access, specialist referrals, hospital care, everything. Prices are typically lower for children than adults—a paediatric consultation might be £12 while adult is £20. The care is identical in quality but slightly cheaper in cost.

School-based preventive care is free: vaccinations, health screenings, dental checks. This is public health infrastructure everyone receives regardless of family income. Catching problems early in children saves vast money later.

Orphans and looked-after children in state care receive full HealthShield coverage with zero contributions required. Their HealthVaults receive annual £1,000 government contributions. They're children without parental support; the state steps in completely.

At 18, the child becomes independent in the system. Their HealthVault—which has been accumulating from the £500 birth contribution plus parental additions plus growth—becomes theirs. They start contributing from their first job. If they're starting work at 18, they might already have £3,000-5,000 in their account from growth alone. That's a health safety net most 18-year-olds historically have never had.

Homelessness: The Basic Floor

A rough sleeper has untreated diabetes. He shows up at an emergency department in crisis. He receives emergency stabilisation. His blood sugar is controlled. He's referred for ongoing care.

But he has no address, no income, no ability to make HealthVault contributions. He receives basic HealthShield coverage on account of his British birth certificate somewhere: emergency care when needed, essential chronic disease management through generic medications, basic mental health crisis intervention.

That's the floor. Nobody dies on the street from treatable conditions.

And we don't need socialism to accomplish it.

What he doesn't receive: elective procedures, dental beyond emergency extractions, comprehensive mental health therapy, preventive care beyond crisis stabilisation. The system provides survival-level care but not comprehensive care. This creates an incentive: secure housing and employment, and healthcare access expands dramatically.

Homeless healthcare outreach teams assist with emergency registration. The OneLife system can track individual zero-knowledge IDs through NHS numbers even without addresses. Rough sleepers can access their medical records at drop-in centres and receive basic care through specialist homeless health clinics.

Upon securing employment, transition to full HealthVault and HealthGuard participation is immediate. First paycheck, contributions start, full system access activates. The pathway out of homelessness includes immediate healthcare improvement as reward.

Criminal Justice: Care Without Reward

Prisoners receive basic HealthShield coverage only. Emergency care is covered. Chronic conditions receive basic generic medications. Mental health gets basic counselling. Dental is emergency only. No elective procedures during incarceration.

Why? Because incarceration is punishment for crime. The state provides humane minimum care as required by basic decency and human rights. But prisoners don't accumulate HealthVault balances. They don't receive full healthcare access. Limited healthcare is part of the consequence of criminal conviction.

Prison healthcare is delivered by contracted Health Foundations at minimum statutory standard. It's not neglect. It's not cruelty. It's basic, functional healthcare appropriate to the custodial setting.

Upon release, former prisoners immediately regain full HealthVault and HealthGuard rights if they were participating in the system before incarceration. If they were contributing before arrest, those contributions are simply paused during prison and resume upon release. Their account is waiting for them.

Victims of violent crime receive zero attachment point treatment for injuries from the crime. Costs are recovered from offender restitution orders or the Criminal Injuries Compensation Authority. Trauma counselling for crime victims receives twelve free sessions through HealthShield regardless of victim's income.

Workplace Injuries: Employer Liability Integrated

You're injured at work. Emergency treatment happens immediately through HealthGuard. Your employer's liability insurance reimburses HealthGuard retrospectively. You never see a bill. Never wait for insurance companies to settle.

The system separates immediate care from liability determination. First, you get treatment. Then, insurers and lawyers determine responsibility and payment. But treatment never waits for legal resolution.

Long-term disability from workplace injury triggers CareShield benefits just like any other disability. The monthly payment continues for life. Your employer may face additional damages in civil court, but your medical care and disability support flow regardless of that legal process.

Medical Malpractice: No-Fault Compensation

A surgeon makes a mistake. Your recovery takes twice as long and requires additional surgery. Under the old system, you'd spend years in litigation hoping to prove negligence, recover damages, and have costs covered.

The No-Fault Compensation Scheme provides immediate standardised compensation for harm caused by medical treatment, regardless of whether clinical negligence occurred. Funded by a levy on Health Foundations and HealthGuard funds, the scheme pays rapidly without requiring proof of fault.

Treatment of complications from medical harm receives zero attachment point coverage. If the system harmed you, the system fixes it at no cost to you. This is automatic, not requiring applications or appeals.

You can still pursue clinical negligence litigation if you want additional damages, but the scheme provides immediate support rather than leaving you waiting years for court resolution. Most people take the quick standardised payment and move on rather than entering litigation lottery.

Unsafe providers face immediate license suspension by the Health Standards Authority. Patients must be transferred to alternative Health Foundations within seven days. The patient bears no cost from the transfer.

Conscientious Objection: Balancing Rights

A Catholic doctor refuses to prescribe contraception. A Muslim surgeon won't participate in gender transition procedures. A deeply religious GP objects to abortion referrals.

Individual practitioners have conscientious objection rights for abortion, euthanasia, and gender transition procedures. They must immediately refer to a willing colleague. They cannot refuse emergency care. They cannot refuse to treat patients based on lifestyle—a Christian doctor cannot refuse to treat a smoker or obese patient.

Religious Health Foundations—a Catholic network, for instance—may exclude specific services from their offerings: contraception, abortion, sterilisation. But they must advertise these restrictions prominently.

If you choose such a network knowing its restrictions, you've accepted the limitations.

However, emergency contraception in sexual assault cases has no opt-out. It's provided regardless of the Foundation's religious character. Some services are so fundamental the system overrides institutional objections.

For services excluded by your chosen Foundation, you can access them through another Foundation on a pay-as-you-go basis from your HealthVault. Or you switch Foundations during the next open enrolment. Patient choice works both ways: providers can maintain values, patients can choose different providers.

The Frontier Care Programme: Terminal Illness and Experimental Treatment

You're 54. You have stage IV pancreatic cancer. Standard treatment offers 18-month median survival. An experimental immunotherapy trial is recruiting at a research hospital. Under standard approval processes, the trial might never reach you.

The Frontier Care Programme fast-tracks experimental treatment access for terminally ill patients. If you have a prognosis under 24 months, standard treatments exhausted or unsuitable, full mental capacity to consent, and a condition matching active research protocols, you can opt into cutting-edge experimental therapies.

Everything is covered: the experimental drug, monitoring, hospitalisation, travel and accommodation for you plus one companion. The pharmaceutical company or research sponsor pays treatment costs. HealthGuard covers any complications. You can withdraw any time and return to standard care.

Ethics approval follows an accelerated four-week pathway rather than six months. The question isn't "is this treatment proven safe and effective?" because it isn't. The question is "does this patient, who will die soon anyway, understand the risks and choose to try something experimental?"

This serves three purposes.

Terminally ill patients gain access to potential life-extending treatments unavailable through standard channels. Researchers get real-world data from motivated participants. The system saves money because experimental care often costs less than expensive end-of-life care patients might otherwise receive.

About 15-20% of terminal patients choose experimental treatment over standard end-of-life care. The system treats this as win-win-win: patient autonomy, medical advancement, and cost savings all align.

If experimental treatment succeeds and prolongs life, you return to standard HealthVault and HealthGuard rules. The experiment became your treatment. If it fails, end-of-life care is fully covered.

No financial inducements are offered. The treatment is free, but you're not paid to participate. Exploitation prevention is strict: the researcher cannot be your treating physician, no enrollment quotas exist for Health Foundations, and vulnerable populations are excluded unless special advocates are appointed.

Voluntary Medical Records Sharing

Your OneLife record contains decades of medical history: every treatment, every outcome, every medication response. This data, aggregated across millions of people, could revolutionise treatment understanding.

You can opt into the Data for Future Care Programme. Your complete anonymised OneLife record becomes available for research: treatment effectiveness studies, drug safety monitoring, AI diagnostic training, health economics, outcome prediction.

In return, you receive £100 annually in your HealthVault. It's not payment for your data exactly—data isn't really sellable in that sense. It's appreciation for contributing to medical knowledge.

The anonymisation is robust but linkable to outcomes. Researchers can track whether Treatment A or Treatment B produces better five-year survival for your condition without knowing your identity. This is vastly more valuable than disconnected anonymous snapshots.

You get paid for it.

You can withdraw permission any time. Data already shared remains available, but no new data is added. For deceased patients, next of kin can consent to continued research use in exchange for a one-time £500 HealthVault contribution to the estate.

Gender Nonsense: Excluded from Coverage

Gender transition treatments, hormone therapy, and surgery are explicitly excluded from coverage under HealthVault, HealthGuard, or HealthShield. These are classified as elective lifestyle choices, not medical necessities. Patients seeking such treatments fund them entirely through private means.

This exclusion protects taxpayer conscience. In a system based on social insurance for shared unavoidable risks, gender transition doesn't qualify. You can pursue transition privately if you choose. The system doesn't prevent you. But it doesn't fund you either.

Fertility Treatment: Limited Support

One full IVF cycle is covered through HealthVault for married women under 40 with documented medical infertility. This requires a medical diagnosis showing why natural conception isn't working and at least two years of marriage.

Additional cycles beyond the first are not covered. Egg or sperm freezing is covered only if cancer treatment is planned. Elective social egg freezing receives no coverage. Fertility treatment for single women or men without female partners is excluded.

Surrogacy arrangements—commercial or altruistic—are not covered under any circumstances. These fall outside the system's scope entirely.

The logic is straightforward: helping couples facing medical barriers to conception is humane and reasonable. Funding unlimited attempts or elective fertility choices without medical necessity exceeds what social insurance should provide.

Keeping Politicians Out

The Secretary of State for Health has no operational authority over Health Foundations or HealthGuard funds. Cannot direct individual treatment decisions. Cannot mandate coverage of specific treatments. Cannot appoint network or fund leadership. Cannot override regulator decisions. Cannot set prices or wages.

What politicians can do: adjust Healthshield eligibility and funding levels, modify healthy behaviour incentive levels, set strategic health priorities like mental health investment or cancer screening targets, negotiate international healthcare agreements.

Major structural changes to the Universal Health Framework require 60% parliamentary supermajority. This prevents one party winning a narrow majority and dismantling the system. The framework has constitutional protection beyond normal legislation.

Politicians cannot simply vote themselves more health spending to buy votes.

This political insulation is deliberate. Healthcare systems die when they become political footballs. The Universal Health Framework builds cross-party durability through structural protections.

Fifteen Years From Here to There

You cannot flip a switch and replace the NHS overnight. The Universal Health Framework phases in over fifteen to twenty years through four overlapping stages.

Foundation Phase (Years 1-4)

Legislation passes establishing the legal framework. National Insurance contributions redirect to personal HealthVaults. Everyone working sees their first deposit: about £300 monthly from their salary plus employer contribution. The money starts growing immediately.

Existing NHS trusts convert to independent Community Benefit Societies. The physical buildings and staff transfer to the new legal entities. Nothing changes for patients initially—they still show up at the same hospitals, see the same doctors. But ownership and governance shift from government control to independent not-for-profit organisations.

The attachment point starts at £500, not £2,000. This gradual increase over five years prevents sudden cost shock. Most people don't hit £500 annually in the first years because HealthVault balances are low. They're still accessing care much as before.

A single national HealthGuard fund launches. Competition comes later. The initial goal is getting the catastrophic insurance layer operational before fragmenting into competing funds.

HealthShield launches for the poorest 15%. They transition from NHS coverage to HealthShield coverage seamlessly. Their care continues unchanged, but the funding mechanism shifts.

Emergency care and pregnancy pricing are implemented immediately. These work from day one because they're simple: you show up, you receive care, someone else pays.

Competition Phase (Years 5-10)

The attachment point rises from £500 to £2,000 gradually. As HealthVault balances grow and people become accustomed to managing health spending below the threshold, the threshold rises to its target level.

HealthGuard fund competition begins. The single national fund breaks into at least four competing funds. Eventually eight to twelve operate. Annual open enrolment starts. People choose their fund based on service quality, provider networks, and reputation.

Network boundaries become fully overlapping. Initially the twelve to fifteen Health Foundations have somewhat distinct geographic areas. This gradually shifts to overlapping coverage so everyone has real choice between multiple Foundations.

Private clinics and overseas providers join Foundation networks. A private surgical centre contracts with three Health Foundations to offer capacity. A hospital in Warsaw joins five Foundations' overseas provider networks. The system opens to global healthcare access.

The healthy behaviour programme becomes fully operational. Annual wellness checks happen across the country. ActivePlus bonuses start appearing in HealthVaults. People discover hitting targets means real money.

Maturity Phase (Years 10-15)

Full competition between HealthGuard funds and Health Foundations is operational. The system works as designed. Patients choose, providers compete, money follows quality.

The employer contribution begins phasing down. Initially 50/50 employee-employer, it shifts toward 100% employee over five years. This happens through a combination of: making employer contributions fully tax-deductible against corporation tax, grandfathering where new employees pay zero employer share while existing employees continue the old split, and salary conversion where employers give employees the cash they were paying in employer contributions.

Average HealthVault balances reach £80,000-150,000 for people in their 50s. The accounts are real wealth now, not just abstract insurance. People see the inheritance building. Behaviour changes.

Workforce transition support is in full operation. NHS administrators whose jobs disappear receive retraining funding, redundancy packages, or early retirement options. Many administrative functions still exist—Health Foundations need administrators—but the vast NHS bureaucracy slims to something proportional to actual needs.

Optimisation Phase (Years 15-20)

The system is fully mature. Waiting lists are essentially gone because competition and healthcare tourism provide alternatives. Total spending stabilises around 8-9% of GDP compared to 12% before reform and 18% in America.

HealthVault balances at retirement average £150,000-300,000 depending on health history and market performance. This becomes inheritable family wealth. The birth rate stabilises through pregnancy being nearly free. Obesity and smoking rates fall substantially due to ActivePlus incentives.

The system continuously improves based on outcome data. International best practices integrate quickly because Health Foundations compete on innovation. Technology and AI enhance diagnostics and treatment. Preventive care emphasis increases because preventing disease is cheaper than treating it.

State health spending falls to about 4-5% of GDP—roughly half current levels. This isn't cuts. It's the mathematical result of pre-funding through HealthVault and HealthGuard rather than pay-as-you-go taxation. Singapore spends 2.2% public, 5% total. Britain won't quite match that because the population is older, but the direction is clear.

The Invisible Architecture

The Universal Health Framework succeeds because incentives correspond across every participant.

Individuals spend their own money below £2,000, so they care about value. They're not ordering every test imaginable because someone else pays. But they're not avoiding necessary care because they're bankrupted either. The balance is precise.

Individuals accumulate wealth in HealthVault, creating an incentive to stay healthy. Every pound saved is a pound inherited. Parents think about legacy. The incentive structure that was broken—spend everything because it's "free," neglect health because treatment is "free"—flips to something functional.

Health Foundations compete on quality and outcomes because patients can leave. Bad service means losing members and revenue. A Foundation that can't deliver hip replacements in reasonable timeframes loses patients to competitors who can. The accountability is immediate and financial.

HealthGuard funds compete on service and efficiency. A fund processing claims slowly or providing poor customer service loses members. A fund maintaining low administrative costs can invest more in care coordination and preventive programmes, attracting members. The mutual and Community Benefit Society structure ensures any surplus benefits members, not external shareholders.

Providers within Health Foundations compete too. A GP who's consistently rude or dismissive loses patients to other GPs within the Foundation and across Foundations. A specialist with great outcomes and short waits attracts referrals. The internal competition within Foundations prevents the problems of large monopolies where nobody can be fired and service doesn't matter.

Employers benefit from eventually shedding healthcare contributions, which currently cost about £3,000 per employee annually. This makes British workers more competitive internationally and allows employers to redirect that money to wages or investment. The phase-down happens gradually so there's no sudden shock, but the endpoint is businesses without healthcare cost burden beyond whatever they choose to provide as benefits.

The state benefits from dramatically lower expenditure. Providing HealthShield for the poorest 15% and funding universal provisions like emergency care costs about half what the NHS costs. The state can reduce taxes, reduce borrowing, or increase spending elsewhere—or all three in combination.