The Great Fiat Scam: Debt Slavery And The Reckoning

The state commits the same act it jails counterfeiters for — only bigger. With national debt racing past £2.8 trillion and CBDC control looming, The fiat edifice has been crumbling since the Nixon shock. What replaces it will define whether we live as free citizens or digital serfs.

If you or I invested in top-of-the-line printing gear, hunted down polymer substrate, replicated holograms and microtext to forge a single flawless Bank of England note and dared to spend it, the hammer would fall hard: charges under the Forgery and Counterfeiting Act, years in prison. The act is criminal because it undermines the very foundation of trust in money.

The British Government, via the Bank of England and its stiletto-heeled employees, executes precisely the same process under state monopoly it has on force —only vastly larger, systematic, and sanctioned by legislative fiction. No prosecution when it turns the printers on and exerts a stealth proxy tax on the poor. No outrage in the courts when its irresponsibility bankrupts the treasury. Merely nods from the commentariat about more necessary stimulus of something which is only valuable because we perceive it is. It's the price we pay for the stable, predictive exchange of goods and value.

Quantitative easing, – otherwise known as arbitrarily creating numbers out of thin air – ballooned the Bank's balance sheet since 2009 from modest levels to peaks beyond £900 billion, largely through buying government gilts with freshly created digital reserves. New money springs into being, attached to interest-bearing public debt from inception. Public sector net debt now exceeds £2.9 trillion—at least 95–100% of GDP as recent ONS figures confirm—with borrowing persisting and annual interest costs surpassing £100 billion, eclipsing defence spending and rivaling education outlays.

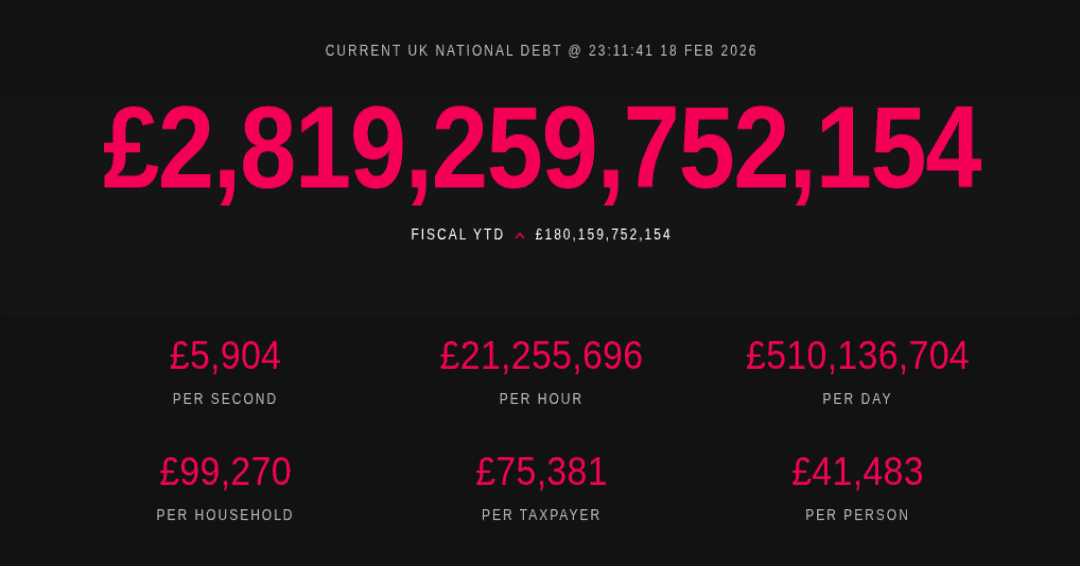

The debt clock at debt-clock.org (UK variant) exposes the spiral in real time: as of mid-February 2026, total national debt hovers near £2.82 trillion and climbing at roughly £5,900 per second, £21 million per hour. Debt per person: over £41,000. Per household: nearly £100,000. Per taxpayer: higher still. Every infant born carries this invisible chain before their first cry. Our descendants will either toil eternally to service it—or the fiat edifice collapses.

No fiat currency in history has lasted indefinitely without debasement or reset. The endgame nears, and a generation of reformers need to take note.

Fractures accelerate. China, Russia, India, Brazil, and allies hoard gold and silver at record pace. Central banks in these nations snap up hundreds of tonnes yearly; BRICS control a commanding portion of global stocks and production. Trade shifts to local currencies, commodity settlements, de-dollarisation (and de-fiat) becomes doctrine in major capitals.

When fiat trust evaporates—via hyperinflation, default cascade, war, or exhaustion—the reset arrives. Sound money anchored in unprintable gold and silver always beckons for the prepared. Yet the dominant vision from global institutions rarely features metals, despite them being the safe harbour of all history. It promises central bank digital currencies (CBDCs), universal digital ID, programmable cash, and a "National Living Wage" funneled straight to approved wallets.

China demonstrates the model: digital yuan rolls out; social credit scores govern access to transport, jobs, loans, education. Pandemic-era health codes turned phones red, mandating immediate home confinement under threat. The apparatus is ready: unified ID, pervasive tracking, conditional privileges. Technocrats simply can't help themselves and nobody ever tells the man with the clipboard... no. Go home, and let the garden grow, and get a little dangerously out of control.

Physical cash—the final bastion of privacy—disappears for "efficiency." Transactions become fully surveilled and revocable. Authorities deem entire demographics of people "non-compliant," "extremist," or burdensome? Digital stipends halt. Accounts lock. Movement curtails. No alternative tender. No undetected trade. Dissent shrinks to your postcode, enforced by algorithm.

How many decades do the press need to complain we are "sleepwalking into an Orwellian surveillance state" until they tell us we're in one? It's the plot of every sci-fi thriller for the last thirty years and seemingly the script blueprint for apparatchiks.

The young confront the harshest binary: submit to digital identity card feudalism for the conditional dole—or reject it and face economic exile, perhaps worse in extremes. Modern slavery dispenses with iron; it deploys convenience, "inclusion," and computer code.

The great money fable falters. Debt grows beyond arithmetic repayment without endless, impossible growth resources and birth rates deny. Metals provide refuge for the vigilant. Digital serfdom awaits the unwary.

The British debt clock spirals upward.

A reckoning is inevitable—only the victor remains undecided.